UCG Contributor/Getty Images

What you need to know

- The stock and bond market will be closed for New Year’s Day on Wednesday. The bond markets will close at an early hour on Tuesday.

- The data for pending sales of homes, home prices indexes and construction spending is due to be released this week.

- Investors will also want to keep an eye on the Manufacturing Sector Purchasing Managers index surveys.

- Richmond Fed President Tom Barkin delivers remarks Friday.

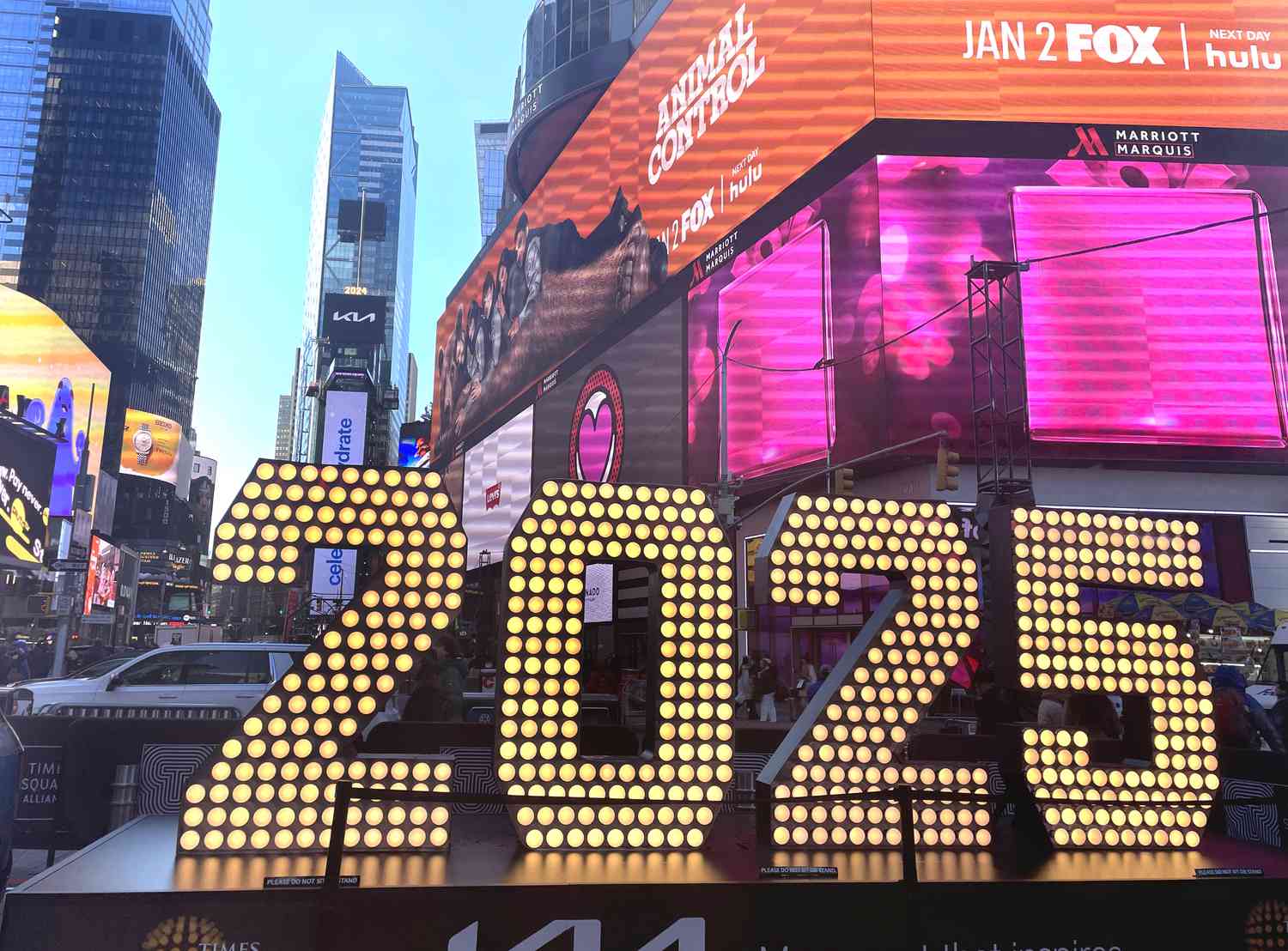

Stock and bond markets will close early on Tuesday for New Year’s Eve. The bond markets will close at an early hour on New Year’s Day. The Santa Claus Rally will also be decided.

The week ahead could be a busy one for real estate, construction, and housing. Expect to hear about pending home sales in November, the home price index for October, as well as November’s construction expenditures. Investors should also be looking forward to the Purchasing Managers Index survey results for manufacturing.

Tom Barkin, President of the Richmond Fed, will address Maryland Bankers Association on Friday.

Monday, Dec. 30

- Chicago Business Barometer for December

- Dallas Fed manufacturing survey (December)

- Pending home sales (November)

Tuesday, Dec. 31 (New Year's Eve)

- S&P Case-Shiller Home Price Index (October)

- FHFA House Price Index for October

- Bond markets close at 2 p.m. EST

Wednesday, Jan. 1 (New Year's Day)

- The stock and bond markets are closed

Thursday, Jan. 2

- Initial Jobless Claim (Week ending December 28)

- Construction Spending (November)

- S&P final U.S. manufacturing PMI (December)

- Lifecore Biomedical reports its earnings

- Tesla (TSLA) fourth-quarter deliveries expected

Friday, Jan. 3

- Manufacturing PMI from the Institute for Supply Management.)

- Richmond Fed President Tom Barkin delivers remarks

New Year’s Day Markets closed

On Wednesday, both the stock and bond market will be closed for New Year’s Day. The bond market closes at 2 pm on Tuesday. New Year’s Eve is celebrated at ET.

Data due on Construction and Real Estate

The National Association of Realtors’ pending sales data will reveal on Monday whether or not the increase in home purchases in November continued. It’s not the only piece of real estate data that investors will be getting, as the Tuesday release of the S&P Case-Shiller Home Price Index could show whether home prices hit another record high in October. On Tuesday, the Federal Housing Finance Agency will also release data about home prices.

Census Bureau to release November construction expenditure data on Thursday. This report includes information on the construction of houses, factories and roads.

The Labor Department's weekly initial jobless claim report will follow its normal Thursday release schedule. This comes as the Labor Department’s weekly initial jobless claim report is released on Thursdays.

Also in store this week is PMI data for the manufacturing sector, with S&P Global releasing its survey on Thursday, and the widely followed ISM data coming on Friday.

Tom Barkin, Richmond Fed president, will also address the Maryland Bankers Association on Friday. His comments follow recent remarks by other Fed officials who were optimistic about the interest rate situation after the central banks lowered their projections of rates reductions through 2025.

This week, there are few corporate earnings reports scheduled. Tesla investors will likely watch for the company's latest quarterly deliveries report, which is expected Thursday. Lifecore Biomedical, a Minnesota-based company, is set to also release its quarterly financial results on Thursday.

Can the markets provide a Santa Claus Rally?

The Investors refer to this tendency to see stocks rise in the final five sessions of a year, and then the first two of the following as “the “Santa Claus Rally.” That means that Friday’s close—marking the end of the second session of 2025—will provide this season’s final reading.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.