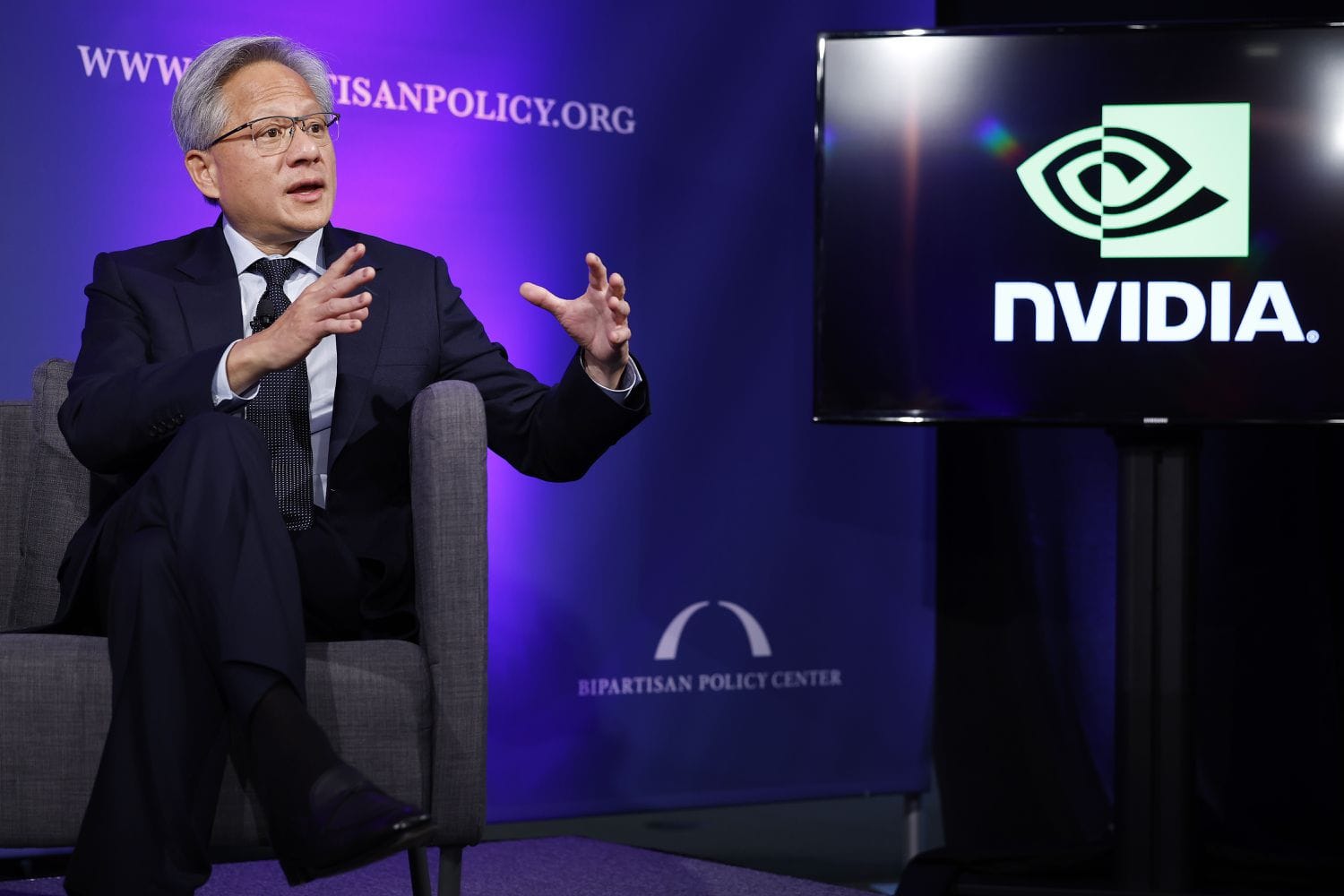

Chip Somodevilla / Staff / Getty Images

UPDATE—Nov. Updated November 20, 2024 to include more recent analyst estimates, share price information and updated data.

What you need to know

- Nvidia’s third-quarter results will be announced after the closing of the markets on Wednesday.

- Analysts predict that demand for artificial intelligent infrastructure and record sales of data centers will lead to a revenue increase at the chipmaker.

- Investors will also be watching for updates on Nvidia's Blackwell AI chip shipments.

Nvidia’s (NVDA) third-quarter earnings will be announced after the bell on Wednesday. The company, which is the most valuable in the world, is projected to show revenue growth due to the demand for AI (artificial intelligence) infrastructure.

Wall Street analysts are expecting the chipmaker to increase its revenue 84% from a year ago to $33,29 billion, and to boost net income by $17,47 billion, or 70 cents, from $9.24billion, or 37c per share. Nvidia underwent a 10-for-1 stock split in June.

| Analyst Estimates for Q3 2025 | Q2 2025 | Q3 2024 | |

| Earnings | $33.29 Billion | $30.04 billion | $18.12 billion |

| Earnings per share | 70 Cents | 67 Cents | 37 cents |

| Net Income | 17.47 billion dollars | $16.6 billion | $9.24 billion |

Key Metric: Revenue from Data Center

Nvidia’s revenue from data centers reached a new record of $26.3billion in the second-quarter. Analysts predict that it will reach another high of $29,28billion in the third-quarter. In August, CEO Jensen Huang said, “global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative AI.”

Morgan Stanley has raised its price target on Nvidia shares to $160, up from $150. “overweight” The rating cited the growth of its data centers as a reason for the high ranking.

"We expect NVDA's Data Center business to drive much of the growth over the next 5 years, as enthusiasm for generative AI has created a strong environment for AI/[machine learning] hardware solutions," the analysts said.

Blackwell Supply Business Spotlight

Huang has called Nvidia Blackwell AI’s chip “the most important AI chip in the world”. “a complete game changer for the industry.”

However, Morgan Stanley analysts warned supply constraints could limit the upside of Nvidia's near-term outlook, adding "we think the bigger upward revisions happen later in the year." Nvidia expects Blackwell revenues of several billion dollars to be shipped during the first quarter due to production ramp-up.

The value of Nvidia shares has nearly tripled since the beginning of the year. They were trading at $145.36 on Wednesday afternoon.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.