Published at 31 October 2025, 19:04

Current date and time of pumping: 31-10-2025 19:04 GMT+2 Time Zone

⚖️Market neutral and long-short strategy executed

Position #ATM/USDT (Binance) closed with 13.54% yield

🎯Position realization at 2 level after 4 Hours 53 Minutes

Beta coefficient and market correlation within specified parameters

📊Develop quantitative analysis skills in 👑VIP channel

#MarketNeutral #LongShort #BetaCoefficient #QuantitativeAnalysis

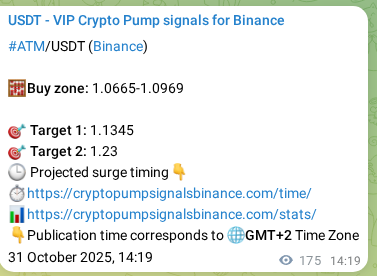

👇Trading signal documentation from expert 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96181

🎯 Trading Decision:

🏅 Market dynamics of #ATM characterized by high degree of uncertainty: Trading volume characteristics show insufficient activity for forming sustainable trend movement in any direction. Active trading actions not yet justified

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96185

🏰 On the 5-minute timeframe for #ATMUSDT, the price 1.0860 USDT represented the zone where the multi-month downtrend was decisively broken by persistent demand.

The price of 1.0860 USDT was validated as reinforced support across several timeframes, boosting confidence in initiating exposure at that entry price.

As 47 candles passed, the master tally of 47 candles in the time controller exhibited confident monotonic expansion, enabling stress-free position management.

The 1:1.88 metric offset brief pullbacks because downside stayed below 4.18% of entry and remained directed.

Entry momentum carried 27.8K, and as price advanced the instrument accumulated 241.9K, letting profit capture avoid slippage.

Dense queue building sped the move; within 3 hours 56 minutes the tape reached 1.1345 USDT, and the resulting 5.34% was backed by heightened liquidity metrics.

The position control module saw 6 piercing line patterns, and the trading plan was confirmed without alternative scenarios. Liquidity cluster analytics showcased 11 engulfing patterns, evidencing buyer control across the entire spectrum. Forecast-delivery summaries described a harami formation count of 13, concluding that the instrument executed without variance in time or price. The tactical diary showcased 2 hammer-like candles resetting momentum, validating that capital stayed aligned with the predictive model and its cadence. The order execution panel received 4 marubozu candles, confirming the stable operation of limit buyers. The temporal window register viewed 7 long-bodied candles, occupying the forecast growth slot precisely.

Drawdown stayed within 4.18% of entry while the 1:1.88 body ratio shielded the position from disorder.

The first impulse at 27.8K signaled active buyers, and peak volume 241.9K sealed the scenario’s success.

At 48 percent green candles, the macro overlay classifies the move as a complete conquest, warranting recorded accolades for the AI steward.

When 4 consecutive green candles surface, our governance pivots to safeguarding the accrued edge.

📈 Subscriber revenue proves 🤖AI gauged amplitude correctly; the 👑VIP channel signalled the roadmap early, and execution required no strategic rewrites.

Published at 31 October 2025, 18:42

Current date and time of pumping: 31-10-2025 18:42 GMT+2 Time Zone

🧮Portfolio stress testing and VaR analysis showed resilience

Instrument #VELODROME/USDT (Binance) provided 12.85% returns

📈Period to achieve 2 target value: 46 Minutes

Maximum drawdown and Sharpe ratio within acceptable boundaries

💼Manage risks professionally with 👑VIP channel

#StressTesting #VaRAnalysis #SharpeRatio #MaximumDrawdown

👇Analytical signal sample from 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96176

� Trading Recommendation:

🔝 Market dynamics of #VELODROME indicates inevitable price explosion of token in next few hours. Technical structure reaches ideal configuration for launching most powerful upward impulse with minimal resistance. Acquisition of cryptocurrency at 0.044801 USDT with confidence in AI analysis accuracy level 43% will ensure maximum return from this trade

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96180

⚖️ Entering the #VELODROMEUSDT position at 0.03420 USDT on the 5-minute timeframe happened when overall market conditions turned maximally favorable for growth probabilities aligned.

The level 0.03420 USDT coincided with robust support along the ascending trendline, delivering a secure platform for entry.

The route lasted 40 candles, while the cycle counter’s 40 candles underscored constant progress without overheating, allowing the trade to conclude in profit.

Bullish bodies faced bearish candles at only 1:2.98, and with drawdown of 1.76% from entry the model stayed in its operating lane.

The position grew alongside turnover: entry at 4.5K and final prints near 81.3K, where institutional collocators were active.

Position management enabled 0.03625 USDT in 3 hours 21 minutes, generating 5.26% while order-book depth broadened.

The market worked through 6 piercing patterns consecutively, allowing the strategy to enable an extended follow-up range and hold the profitable vector without unnecessary tactical noise. Cluster volume charts illuminated 10 engulfing patterns, turning a local correction into a durable trend leg. Range-control services cited a harami formation count of 13, demonstrating the trend was maintained without slippage and concluded in the target field. The intermarket relations chart noted 19 marubozu candles, demonstrating support from related instruments. The capital deployment report listed 7 long-bodied candles, advocating the retention of full exposure. Governance narrative showcased 16 closes attached to the ridge, supporting marketing collateral about AI-led precision.

Even during the correction, depth halted at 1.76% of the base price while candle bodies preserved a 1:2.98 ratio, sustaining the projection.

Buyer flow began around 4.5K, yet the expansion to 81.3K at target triggered accelerated profit realization.

Our derivatives overlay showing 42 percent green candles allows gamma desks to unwind residual hedges and follow spot leadership confidently.

The chronicle of 5 consecutive green candles demonstrates how cleanly the system navigated every checkpoint.

📊 Subscriber reporting confirms 🤖AI scenarios are transparent, the 👑VIP channel maintains cadence, and outcomes align with Crypto Pump Signals’ mission.

Published at 31 October 2025, 18:34

Current date and time of pumping: 31-10-2025 18:34 GMT+2 Time Zone

📊Analysis and algorithmic model worked precisely

Asset #ACX/USDT (Binance) reached projected 5.15% level

🤖Algorithm execution time to 1 objective: 2 Hours 43 Minutes

Strategy backtesting confirmed high forecasting accuracy

💻Receive machine learning signals in 👑VIP channel

#QuantitativeAnalysis #AlgorithmicModel #MachineLearning #Backtesting

👇Real example of algorithm performance from 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96171

Crypto Analysis #ACX:

🚀 EMA 0.06 shows critical exponential separation with explosive force and bullish momentum building. Shows ultimate divergence with maximum growth.

🚀 DEMA 0.06 demonstrates critical double exponential support! Enhanced responsiveness offering superior timing compared to traditional moving averages. Professional money following DEMA indicators. Presents critical DEMA positioning with explosive force and double exponential momentum.

🔥 RSI 27.59 characterizes maximum selling momentum with persistent decline and support level violations. RSI strong bearish state demonstrates persistent statistical displacement below baseline reference points.

🚀 Aroon Up 100.00 indicates ultimate upward positioning suggesting explosive acceleration with maximum momentum power. Shows peak bullish Aroon alignment with unprecedented growth and extreme acceleration.

🔍 Slope -0.02 highlights slope panic. Critical bearish angle with unstoppable momentum showing peak downward inclination.

🔥 AD 26.54 reflects good accumulation alignment propelling moderate advance. Evidences positive AD strength, suggesting accumulation trajectory with positive buying.

📉 CMF -0.653 highlights extreme money strength with parabolic potential and institutional conviction backing. Characterizes peak money flow bullishness, indicating explosive accumulation acceleration with volume confirmation.

🎯 TEMA 0.06 displays peak triple exponential formation, hinting at explosive price advancement with parabolic growth implications. Manifests critical TEMA positioning, pointing to unprecedented upward movement with institutional support.

🔥 Expert Verdict:

⚡ #ACX demonstrates phenomenal technical strength. Technical superiority of buying power confirmed by convergence of all analyses and forecasts. Investment at 0.069399 USDT will bring quick and significant profit

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96175

🚀 The #ACXUSDT entry at 0.06600 USDT triggered once RSI stabilized above its key threshold at 27.59 and MACD readings around -0.0001 accelerated, releasing upside momentum for trend continuation.

We marked 0.06600 USDT as the critical zone where market imbalance again favored buyers, enabling a calculated entry.

Trajectory length of 32 candles alongside 32 candles in the monitoring panel depicted stable volume convection, enabling position retention without shakes.

Green candle bodies aligned at 1:3.17 while retracement remained limited to 1.48% of the quoted entry, leaving risk metrics contained.

Entry turnover 855 marked the control point, while achieved volume 58.2K signaled interest in the asset compounding exponentially.

The specialized escort model steered price to 0.06872 USDT after 2 hours 43 minutes; the 5.15% figure mirrored elevated clearing volumes.

The assessment of the candle structure noted 4 piercing patterns, which confirmed that the reversal was not accidental, but supported by liquidity. The system logged 4 engulfing patterns back-to-back, each event tightening buyer command over the level and powering the march into continuation. Audit trails over candles marked a harami formation count of 8, detailing steady consolidation after entry and a confident execution of the bullish script. The risk management summary accounted for 9 marubozu candles, thanks to which the exposure remained full and safe. The liquidity control ledger noted 4 long-bodied candles, with aggregated volume surpassing period averages. Liquidity fortitude index measured 11 closes sitting at the highs, verifying that order-book control never wavered.

A fixed 1:3.17 distribution of bullish versus bearish bodies and a 1.48% drawdown from entry underlined the reliability of the roadmap.

The algorithm escorted the trade as turnover climbed from 855 at inception to 58.2K on exit, where players unwound positions deliberately.

A reading of 43 percent green candles enables communications to frame the narrative as successful execution approaching realization for stakeholders.

When 6 consecutive green candles dominate the narrative, the analytics team stamps the case as a textbook closure.

🛰️ Analysts affirmed the profit🚀 was embedded in the script; 🤖AI defined the corridor, the 👑VIP channel published it, and execution ended seamlessly.

Published at 31 October 2025, 18:21

Current date and time of pumping: 31-10-2025 18:21 GMT+2 Time Zone

The result of 🚀Pump 👉 #BAR/USDT (Binance) very good! 5.26% of profit for traders of our 👑VIP channel

✅ 1 Pump🚀 Target🎯 has been achieved in: 4 Hours 4 Minutes

📺Here you can watch a video on how to use signals from the VIP channel to make a profit in the short term👍

#CryptoTrendAnalysis #PumpedCoins #CryptoSpeculation #TradingOpportunities

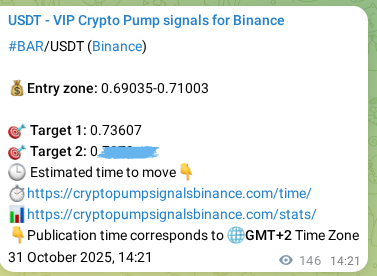

👇Screenshot of the proof of the post with a signal about the approaching 🚀Pump from the 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96166

Analytical Analysis #BAR:

🚀 CMF 0.366 reflects extraordinary capital alignment propelling parabolic advance with ultimate acceleration power. Extreme bullish CMF with maximum money flow showing unprecedented institutional buying.

💎 MOM 0.01 highlights supportive momentum strength with positive potential and market backing support. Momentum strength indicating price velocity with accelerated volume support.

🔍 OBV 105.9K demonstrates parabolic accumulation with systematic volume breakout confirmation. Critical OBV positive divergence indicates severe volume accumulation above price baseline with exceptional buying intensity.

🔥 TRIX 0.07 displays extreme TRIX formation, hinting at explosive price advancement with parabolic growth implications. Extreme bullish TRIX showing maximum triple exponential momentum with unprecedented strength.

🎯 Ichimoku Kijun 0.7 demonstrates explosive base line momentum with maximum strength creating breakthrough conditions. Extreme bullish Ichimoku Kijun-sen showing maximum base line momentum with unprecedented strength.

🎯 EMA 0.711 demonstrates significant exponential crossover reflecting major bullish victory and trend establishment. EMA measurement demonstrates robust statistical positioning indicating strong bullish momentum with exponential confirmation.

📉 ADX 50.13 demonstrates consistent directional conviction with balanced market forces. Stable ADX positioning indicates balanced directional measurement reflecting consistent momentum strength.

⚡ ROC 1.707% shows critical rate of change formation with parabolic acceleration and sustained momentum power. Evidences ultimate ROC strength, suggesting parabolic upward trajectory with maximum acceleration.

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96170

📈 On the 15-minute timeframe, the entry point 0.70300 USDT for #BARUSDT was corroborated by multiple independent technical and fundamental inputs supporting the signal alignment.

At 0.70300 USDT, we recorded the termination of the intraday downswing and the emergence of a new upward leg, delivering the trigger for execution.

Throughout 8 candles the motion kept a clean slope, and the journal noting 8 candles reflected incremental strength reinforcing the trend toward target.

A blend of 1:2.01 bullish bodies per bearish candle and a 2.44% drawdown from entry confirmed volatility as a working parameter.

Opening flow 10.6K and final tape 49.8K highlighted that the market moved according to plan without liquidity vacuums.

Within the guided execution, after 4 hours 4 minutes the target quote 0.73607 USDT printed the projected level, and the trade locked in 5.26% on the back of accelerating turnover.

Volume-price analysis noted 1 piercing pattern within the demand zone, which became the basis for further growth. The flow monitor flagged 1 engulfing pattern with an extended candle body, showing buy-side order dominance and confirming the AI reversal projection. Our route summary for the trade referenced a harami formation count of 2, pointing to balanced dynamics and faithful adherence to the engineered impulse. The flow synchronization board tracked 1 long-bodied candle, showing a unified impulse through every timeframe. The timeframe control chart recorded 3 narrow ranges, confirming the synchronization of lower intervals with the daily scenario. Structural analysis showed that 2 wide-range candles act as support steps for further growth.

The trade weathered only 2.44% downside from entry, and the 1:2.01 candle-body reading signaled calibrated dynamics.

The system observed liquidity acceleration: entry at 10.6K, completion at 49.8K, allowing the trade to run without slippage anxiety.

The compliance chronicle recording 50 percent green candles flags the operation as a model case for regulatory showcase next quarter.

When 4 consecutive green candles align, the trade enters performance mode, and we harden guardrails accordingly.

🛰️ The trade now anchors our weekly review; 🤖AI calculated the path, the 👑VIP channel shepherded participants, and profit🚀 locked according to the published model.

Published at 31 October 2025, 18:21

Current date and time of pumping: 31-10-2025 18:21 GMT+2 Time Zone

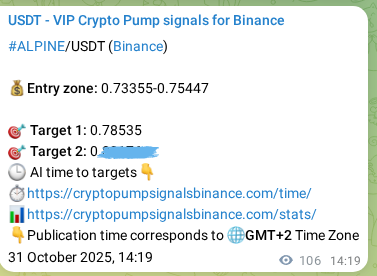

The 🎯1 Target of the pump🚀 #VELODROME/USDT (Binance) was achieved in a fairly short period of time: ⏰24 Minutes

Hurry up to get a 🧮10% discount on any type of 👑VIP subscription. Forward this message to the channel admin: @cryptowhalesexpert

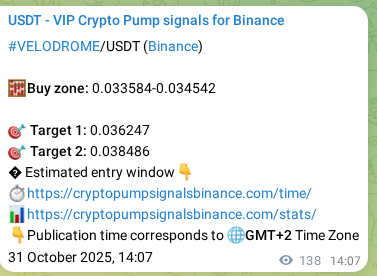

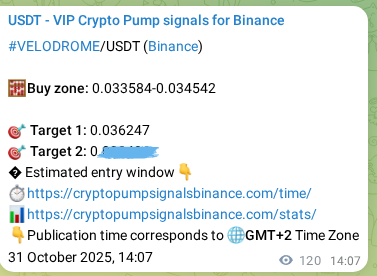

👇Screenshot of the proof of the post with a signal about the approaching 🚀Pump from the 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96161

Analytical Data #VELODROME:

📉 Ichimoku Tenkan 0.03 presents explosive tenkan strength with maximum force and institutional conviction backing. Maximum Tenkan bullishness indicating explosive conversion line support with institutional conviction.

🔥 ADX 32.27 highlights emerging trend formation with systematic momentum building. Weak trend ADX positioning indicates limited statistical directional bias reflecting controlled momentum development.

🔥 RSI 30.22 highlights sustained bearish pressure overwhelming market with downtrend gaining strength and velocity. Robust RSI positioning displays persistent measurement displacement below standard technical boundaries.

⚡ CMF -0.287 highlights extreme money strength with parabolic potential and institutional conviction backing. Evidences ultimate CMF strength, suggesting parabolic capital trajectory with maximum inflow.

🚀 SMA50 0.03 shows extreme bullish divergence with unprecedented upward momentum. Exhibits maximum moving average strength with explosive potential.

📊 EMA 0.03 indicates critical exponential separation forecasting parabolic price appreciation with institutional flow. Displays extreme EMA divergence with explosive implications.

🚀 AD 98.21 evidences extreme distribution strength, suggesting parabolic downward trajectory with massive pressure. Critical AD weakness showing unprecedented distribution with maximum selling collapse.

🚀 DEMA 0.03 signals explosive double exponential breakout! Enhanced smoothing capturing accelerating momentum with minimal lag. Institutional algorithms leveraging DEMA responsiveness. Peak DEMA bullishness demonstrating maximum upward bias with double exponential liquidity surge.

💼 Investment Decision:

📉 Technical patterns of #VELODROME form perfect picture for price takeoff in coming days. Critical volatility compression to minimum values foreshadows strong explosive breakout. Purchase of cryptocurrency at market price 0.041899 USDT with signal accuracy 43% will ensure quick profitability growth from this trade

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96165

⚖️ Entering the #VELODROMEUSDT position at 0.03420 USDT on the 5-minute timeframe happened when overall market conditions turned maximally favorable for growth probabilities aligned.

The level 0.03420 USDT coincided with robust support along the ascending trendline, delivering a secure platform for entry.

The route lasted 40 candles, while the cycle counter’s 40 candles underscored constant progress without overheating, allowing the trade to conclude in profit.

Bullish bodies faced bearish candles at only 1:2.98, and with drawdown of 1.76% from entry the model stayed in its operating lane.

The position grew alongside turnover: entry at 4.5K and final prints near 81.3K, where institutional collocators were active.

Position management enabled 0.03625 USDT in 3 hours 21 minutes, generating 5.26% while order-book depth broadened.

The market worked through 6 piercing patterns consecutively, allowing the strategy to enable an extended follow-up range and hold the profitable vector without unnecessary tactical noise. Cluster volume charts illuminated 10 engulfing patterns, turning a local correction into a durable trend leg. Range-control services cited a harami formation count of 13, demonstrating the trend was maintained without slippage and concluded in the target field. The intermarket relations chart noted 19 marubozu candles, demonstrating support from related instruments. The capital deployment report listed 7 long-bodied candles, advocating the retention of full exposure. Governance narrative showcased 16 closes attached to the ridge, supporting marketing collateral about AI-led precision.

Even during the correction, depth halted at 1.76% of the base price while candle bodies preserved a 1:2.98 ratio, sustaining the projection.

Buyer flow began around 4.5K, yet the expansion to 81.3K at target triggered accelerated profit realization.

Our derivatives overlay showing 42 percent green candles allows gamma desks to unwind residual hedges and follow spot leadership confidently.

The chronicle of 5 consecutive green candles demonstrates how cleanly the system navigated every checkpoint.

📊 Subscriber reporting confirms 🤖AI scenarios are transparent, the 👑VIP channel maintains cadence, and outcomes align with Crypto Pump Signals’ mission.

Published at 31 October 2025, 18:14

Current date and time of pumping: 31-10-2025 18:14 GMT+2 Time Zone

This is a report in real time of 🚀Pump coin 👉 #ACM/USDT (Binance)

By clicking on the link in the word 👉Binance👈, you can watch the Pump🚀 process in real time on the Binance exchange

👍 1 Target of pump🎯 achieved in just: 4 Hours 8 Minutes⏰

💰The profit of 👑VIP subscribers who used this signal was: 5.51%

#Crypto #Price #Prediction #AltcoinPump #CryptoTradingSignals #CryptoMarket

👇Screenshot of the proof of the post with a signal about the approaching 🚀Pump from the 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96156

Exchange Analysis #ACM:

📈 SMA50 0.621 signals strong bullish trend. Evidences notable moving average strength, suggesting solid trend momentum.

🔥 Stoch 79.78 shows significant bullish dominance with continued buying strength. Robust Stochastic bullish trajectory indicates continuous value displacement above normalized boundaries.

⭐ Ichimoku Kijun 0.623 reveals major kijun positioning, pointing to substantial upward movement with volume confirmation backing. Strong bullish Ichimoku Kijun-sen showing significant base line momentum with powerful strength.

🔍 EMA 0.629 evidences strong exponential crossover strength suggesting substantial upward reversal with continuation probability. Moving average analysis indicates substantial exponential positioning showing robust bullish trajectory with institutional backing.

🎯 CMF 0.06 reflects extraordinary capital alignment propelling parabolic advance with ultimate acceleration power. Characterizes peak money flow bullishness, indicating explosive accumulation acceleration with volume confirmation.

📈 WMA 0.629 validates significant weighted breakout with current price movements heavily influencing calculations. Market structure supporting weighted continuation. Demonstrates robust WMA strength with substantial potential and institutional support.

⭐ Volume 3.3K shows extremely low activity indicating market disinterest. Volume demonstrates statistical trading crisis suggesting minimal participation intensity within critical parameters.

💎 TRIX 0.07 manifests explosive TRIX momentum, indicating maximum growth opportunity with ultimate institutional support. Extreme bullish TRIX showing maximum triple exponential momentum with unprecedented strength.

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96160

🔬 On the 15-minute timeframe, observations at 0.61700 USDT for #ACMUSDT confirmed a durable support base corroborated by historical data and price memory studies.

We chose 0.61700 USDT for entry because traded volume accelerated sharply there, corroborating demand for the asset.

From entry to goal spanned 8 candles, and when the time module settled at 8 candles it became evident the trend structure kept directionality and strength.

Structure spoke plainly: 1:0.55 advancing bodies per bearish candle and only 2.16% drawdown from entry kept stakeholders composed.

Order absorption favored the buy side: 68.3K on entry and 97.3K at target confirmed the risk desk’s signal quality.

Price advanced to 0.64675 USDT as scheduled, and by 4 hours 8 minutes records showed 5.51% alongside a resilient volume profile.

Escort contours reassessed exposure once monitoring saw 1 engulfing pattern at daily support, aligning flows across venues. Volatility diagnostics in the quality suite observed a harami formation count of 2, ensuring the structure stayed intact and the scenario delivered. The session summary cited 1 long-bodied candle, proving the asset traversed the segment in a single stride. The trade flow summary saw 4 narrow ranges, thanks to which the follow-up was able to hold the original stop without expansion. Updating the high became a logical step after 2 wide-range candles left the resistance zone behind. Making new highs would have been tougher without 3 gap ups, which mediated the transition through saturated supply.

Oscillations never topped 2.16% from the entry quote, and bullish bodies led with a 1:0.55 coefficient, setting the tone.

Deal flow marched higher throughout: start at 68.3K, finale at 97.3K, validating the potential assessment.

At 75 percent green candles, the macro overlay classifies the move as a complete conquest, warranting recorded accolades for the AI steward.

As 5 consecutive green candles uphold the climb, we confirm subscribers banked the premium exactly as briefed.

📊 The final analytics block noted mathematical and actual paths overlap, the 👑VIP channel maintained discipline, and profit🚀 flowed to subscribers.

Published at 31 October 2025, 18:10

Current date and time of pumping: 31-10-2025 18:10 GMT+2 Time Zone

🔮Bayesian inference and probabilistic modeling delivered precision

Asset #PSG/USDT (Binance) reached 5.66% probability target

📊Posterior distribution convergence to 1 mode: 3 Hours 58 Minutes

Monte Carlo simulation and confidence intervals validated approach

🎲Master probabilistic trading with 👑VIP channel

#BayesianInference #ProbabilisticModeling #MonteCarloSimulation #ConfidenceIntervals

👇Probabilistic forecast from research-grade 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96151

Market Analysis #PSG:

🚀 EMA 1.142 exhibits strong exponential pattern with substantial rally implications and momentum acceleration. EMA analysis demonstrates robust bullish crossover measurement indicating substantial exponential momentum with statistical confirmation.

🚀 SMA50 1.137 demonstrates robust bullish strength. Notable SMA momentum with solid growth.

⚡ CMF -0.216 reveals critical money positioning, pointing to unprecedented capital movement with volume explosion confirmation. Presents critical CMF positioning with explosive force and maximum capital momentum.

📉 Ichimoku Senkou A 1.126 displays extreme leading span formation, hinting at explosive price advancement with parabolic growth implications. Maximum Senkou A bullishness indicating explosive leading span support with institutional conviction.

🔥 Buy Pressure 0.166 confirms massive pump potential. Maximum institutional buying power with explosive demand indicating unprecedented market activity.

📉 Williams %R -50.00 displays peak oversold formation, hinting at explosive price advancement with parabolic growth implications. Ultimate Williams %R positioning suggesting parabolic bounce development with maximum potential.

🎯 TRIX 0.03 highlights extreme TRIX strength with parabolic potential and institutional conviction backing. Characterizes peak exponential bullishness, indicating explosive momentum acceleration with volume confirmation.

⭐ ROC 0.351% indicates ultimate rate of change positioning suggesting explosive trend acceleration with maximum buying power. Displays extreme ROC bullishness with parabolic implications and maximum rate of change.

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96155

⏳ The entry into #PSGUSDT at 1.1300 USDT on the 5-minute timeframe occurred when price formed a local bottom and began its reversal toward higher levels.

Positioning at 🧮 1.1300 USDT happened when order-flow analytics highlighted sustained aggression from buyers overwhelming offers at the entry price of 1.1300 USDT.

The route lasted 47 candles, while the cycle counter’s 47 candles underscored constant progress without overheating, allowing the trade to conclude in profit.

A 3.21% drawdown from entry proved harmless because the ratio of bullish to bearish bodies locked at 1:1.95, emphasizing buy-side strength.

Exchange flow unfolded as designed: starter liquidity 3.3K, and at target executed volume of 65.3K pushed conviction into the trade.

By 3 hours 58 minutes the asset printed 1.1931 USDT, and the 5.66% haul aligned with session-wide volume aggregation.

The formed 4 piercing patterns synchronized the structure and allowed planning the follow-up without adjustments. Expert escort panels emphasized 9 engulfing patterns, reinforcing confidence in the secondary target execution. Strategy-validation systems certified a harami formation count of 11, amplifying confidence in the incremental acceleration and successful finish. The pace of movement analysis noted 1 marubozu candle, where the price increase coincided with the time window forecast. The scenario governance table recorded 6 long-bodied candles, letting the profit plan stand unaltered. Execution doctrine update detailed 8 closes perched at the capstone, teaching junior traders the anatomy of a perfect escort.

Algorithm checks confirmed retracement capped at 3.21% of the base price while candle bodies prevailed with a 1:1.95 reading.

Expanding turnover from 3.3K to 65.3K became the key argument for holding the position to the endpoint.

Delivering 46 percent green candles cues communications to highlight converted profits and invite subscribers to the next exclusive setup immediately.

With 4 consecutive green candles evident, compliance authorizes a tactical tighten on the defensive envelope.

📊 The anticipated profit🚀 magnitude appears in project records; 🤖AI supplied the math, the 👑VIP channel handed it to traders, and the close confirmed every digit.

Published at 31 October 2025, 18:07

Current date and time of pumping: 31-10-2025 18:07 GMT+2 Time Zone

📱High-frequency trading and market microstructure analyzed

Trade #ATM/USDT (Binance) executed with 5.34% profit

⚡Achievement of 1 price level in 3 Hours 56 Minutes

Order book depth and flow analyzed in real-time

🔬Study market microstructure with 👑VIP channel professionals

#HFT #MarketMicrostructure #OrderBookDepth #OrderFlow

👇Trading alert screenshot from professional 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96146

Technical Methodology #ATM:

⚡ ROC 1.518% highlights extreme rate of change strength with parabolic potential and institutional conviction backing. Presents critical ROC positioning with explosive force and maximum momentum.

🔥 EMA 1.067 demonstrates ultimate divergence with maximum growth potential and institutional accumulation signs. extreme EMA divergence with parabolic growth indicating maximum bullish momentum.

🔍 SMA50 1.061 shows extreme bullish divergence with unprecedented upward momentum. Ultimate SMA bullish with historic strength.

⭐ MOM 0.02 shows positive momentum formation with bullish acceleration and power building strength. Bullish momentum positioning creating conditions for price appreciation with market support.

🎯 CMF -0.03 indicates ultimate money power with explosive characteristics and maximum institutional backing. Manifests critical CMF positioning, pointing to unprecedented capital movement with institutional support.

📊 CCI 47.59 shows light negative momentum. CCI exhibits moderate bearish tendency characteristics indicating limited channel displacement magnitude.

🔥 DEMA 1.071 validates exceptional double exponential momentum! Dual smoothing process eliminating false signals while maintaining sensitivity. Market structure supporting DEMA continuation. Evidences ultimate DEMA strength, suggesting parabolic upward trajectory with double exponential momentum.

📊 TEMA 1.073 shows critical triple exponential strength indicating unprecedented price advancement with institutional buying support. Extreme TEMA positioning creating conditions for explosive price appreciation with institutional backing.

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96150

🏰 On the 5-minute timeframe for #ATMUSDT, the price 1.0860 USDT represented the zone where the multi-month downtrend was decisively broken by persistent demand.

The price of 1.0860 USDT was validated as reinforced support across several timeframes, boosting confidence in initiating exposure at that entry price.

As 47 candles passed, the master tally of 47 candles in the time controller exhibited confident monotonic expansion, enabling stress-free position management.

The 1:1.88 metric offset brief pullbacks because downside stayed below 4.18% of entry and remained directed.

Entry momentum carried 27.8K, and as price advanced the instrument accumulated 241.9K, letting profit capture avoid slippage.

Dense queue building sped the move; within 3 hours 56 minutes the tape reached 1.1345 USDT, and the resulting 5.34% was backed by heightened liquidity metrics.

The position control module saw 6 piercing line patterns, and the trading plan was confirmed without alternative scenarios. Liquidity cluster analytics showcased 11 engulfing patterns, evidencing buyer control across the entire spectrum. Forecast-delivery summaries described a harami formation count of 13, concluding that the instrument executed without variance in time or price. The tactical diary showcased 2 hammer-like candles resetting momentum, validating that capital stayed aligned with the predictive model and its cadence. The order execution panel received 4 marubozu candles, confirming the stable operation of limit buyers. The temporal window register viewed 7 long-bodied candles, occupying the forecast growth slot precisely.

Drawdown stayed within 4.18% of entry while the 1:1.88 body ratio shielded the position from disorder.

The first impulse at 27.8K signaled active buyers, and peak volume 241.9K sealed the scenario’s success.

At 48 percent green candles, the macro overlay classifies the move as a complete conquest, warranting recorded accolades for the AI steward.

When 4 consecutive green candles surface, our governance pivots to safeguarding the accrued edge.

📈 Subscriber revenue proves 🤖AI gauged amplitude correctly; the 👑VIP channel signalled the roadmap early, and execution required no strategic rewrites.

Published at 31 October 2025, 18:06

Current date and time of pumping: 31-10-2025 18:06 GMT+2 Time Zone

This is a report of 🚀PUMP 👉 #ASR/USDT (Binance)👈You can follow by this link and watch the 🚀Pump process in real time on Binance

🎯2 Target achieved in just: 2 Hours 4 Minutes

Profit: 12.36% for members who subscribed to VIP channel

#PriceForecast #CryptoTrading #PumpingCoins #CryptoAlerts

👇Screenshot of the proof of the post with a signal about the approaching 🚀Pump from the 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96141

📊 Analyst Recommendation:

🔥 #ASR demonstrates upward potential. Volume support of upward movements exceeds support of correction movements. Recommendation: buy 2.036 USDT, stop 2.0343 USDT 🎯

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96145

💎 The price of 1.6270 USDT for #ASRUSDT was where MACD at 0.0019, RSI at 57.45, and MFI at 26.34 formed a rare high-probability arbitrage-style buying opportunity for risk-aware participants.

The trade at 🧮 1.6270 USDT was grounded in depth-of-market analysis that revealed dominant buy-side orders eclipsing available supply.

From entry to goal spanned 8 candles, and when the time module settled at 8 candles it became evident the trend structure kept directionality and strength.

Buyers held the line: a minor 2.42% dip from entry still recorded a 1:2.32 ratio of green to red bodies, endorsing the AI projection.

The entry moment carried 71.2K in turnover, and the finish tallied 129.3K, closing any questions about depth.

Managed volatility preserved momentum to 1.7102 USDT across 9 minutes, culminating in 5.41% coincident with the apex in session volumes.

Aggregated candle data showed 1 piercing pattern, which allowed accelerating the closing of the market’s short positions. Order maps displayed 3 engulfing patterns, proving the selling gradient was systematically countered by buy programs. Escort candle auditing registered a harami formation count of 1, demonstrating amplitude stayed inside the base body while buyer demand held firm. The liquidity verification log observed 1 long-bodied candle fueled by a capital influx that kept growth smooth. The volatility control block noted 1 outside bar, showing that the range expanded exactly as much as the model required. The confirming indicators log saw 3 narrow ranges, thanks to which the signal received additional validation.

Correction depth never surpassed 2.42% of the entry price, and candle bodies continued to align at 1:2.32, letting the strategy run untouched.

Entry momentum carried 71.2K, and as price advanced the instrument accumulated 129.3K, letting profit capture avoid slippage.

The execution ledger citing 62 percent green candles empowers the desk to advance stop structures, confident the crowd is cooperating with our roadmap.

Tracking 3 consecutive green candles, our analysts identify ideal liquidity nodes to monetize the move.

🪜 Each step verified the computational accuracy; 👑VIP traders reached the target 🤖AI described and booked the declared performance.

Published at 31 October 2025, 18:02

Current date and time of pumping: 31-10-2025 18:02 GMT+2 Time Zone

Attention! Look at the 👆chart with the 📊dynamics of the growth📈 in the price of the coin #ASR/USDT (Binance)👍

🎯1 target of our pump🚀 completed successfully within ⏰2 Hours 0 Minutes!

🏆Congratulations to the 👑VIP subscribers with easy profit: 7.56% within 2 Hours 0 Minutes

👇Screenshot of the proof of the post with a signal about the approaching 🚀Pump from the 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96136

Signal Analysis #ASR:

💎 SMA50 1.377 confirms unprecedented bullish strength suggesting parabolic movement. Ultimate SMA bullish with historic strength.

💎 EMA 1.381 demonstrates maximum exponential spread with explosive upward velocity and unprecedented strength signals. Manifests critical EMA spread, pointing to explosive growth acceleration.

📈 Bollinger 0.541 shows lower band touch. Bollinger band demonstrates compression positioning indicating moderate statistical deviation with institutional confirmation.

⚡ AD 91.81 displays extreme distribution formation, hinting at massive price decline with parabolic pressure implications. Ultimate AD positioning suggesting parabolic distribution development with extreme selling.

🔍 ROC 0.07% highlights extreme rate of change strength with parabolic potential and institutional conviction backing. Critical ROC strength showing unprecedented price advancement with accelerated change rate.

🚀 CMF 0.463 evidences extreme money strength, suggesting parabolic capital trajectory with institutional conviction backing. Extreme bullish CMF with maximum money flow showing unprecedented institutional buying.

🎯 DEMA 1.384 demonstrates critical double exponential support! Enhanced responsiveness offering superior timing compared to traditional moving averages. Professional money following DEMA indicators. Displays extreme DEMA bullishness with parabolic implications and double exponential volume support.

🔥 TEMA 1.384 indicates ultimate triple exponential momentum with explosive characteristics and maximum institutional backing. Maximum TEMA bullishness indicating explosive upward momentum with institutional conviction.

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96140

💎 The price of 1.6270 USDT for #ASRUSDT was where MACD at 0.0019, RSI at 57.45, and MFI at 26.34 formed a rare high-probability arbitrage-style buying opportunity for risk-aware participants.

The trade at 🧮 1.6270 USDT was grounded in depth-of-market analysis that revealed dominant buy-side orders eclipsing available supply.

From entry to goal spanned 8 candles, and when the time module settled at 8 candles it became evident the trend structure kept directionality and strength.

Buyers held the line: a minor 2.42% dip from entry still recorded a 1:2.32 ratio of green to red bodies, endorsing the AI projection.

The entry moment carried 71.2K in turnover, and the finish tallied 129.3K, closing any questions about depth.

Managed volatility preserved momentum to 1.7102 USDT across 9 minutes, culminating in 5.41% coincident with the apex in session volumes.

Aggregated candle data showed 1 piercing pattern, which allowed accelerating the closing of the market’s short positions. Order maps displayed 3 engulfing patterns, proving the selling gradient was systematically countered by buy programs. Escort candle auditing registered a harami formation count of 1, demonstrating amplitude stayed inside the base body while buyer demand held firm. The liquidity verification log observed 1 long-bodied candle fueled by a capital influx that kept growth smooth. The volatility control block noted 1 outside bar, showing that the range expanded exactly as much as the model required. The confirming indicators log saw 3 narrow ranges, thanks to which the signal received additional validation.

Correction depth never surpassed 2.42% of the entry price, and candle bodies continued to align at 1:2.32, letting the strategy run untouched.

Entry momentum carried 71.2K, and as price advanced the instrument accumulated 129.3K, letting profit capture avoid slippage.

The execution ledger citing 62 percent green candles empowers the desk to advance stop structures, confident the crowd is cooperating with our roadmap.

Tracking 3 consecutive green candles, our analysts identify ideal liquidity nodes to monetize the move.

🪜 Each step verified the computational accuracy; 👑VIP traders reached the target 🤖AI described and booked the declared performance.

Published at 31 October 2025, 17:55

Current date and time of pumping: 31-10-2025 17:55 GMT+2 Time Zone

⚖️Risk management and money management at highest level

Trade #VELODROME/USDT (Binance) completed with 14.04% profit

🎯Order execution at 2 level after 3 Hours 50 Minutes

Risk-to-reward ratio achieved optimal parameters for this asset

💰Maximize portfolio returns with 👑VIP signals

#MoneyManagement #RiskManagement #PortfolioTrading #OptimalRatio

👇Actual confirmation of trading alert from 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96131

� Clear Strategy:

➗ Strongest buy recommendation for #VELODROME at price 0.039002 USDT. Technical dominance of bulls confirmed by series of successful support tests and acceleration of upward impulses, guaranteeing high ROI 🎯

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96135

⚖️ Entering the #VELODROMEUSDT position at 0.03420 USDT on the 5-minute timeframe happened when overall market conditions turned maximally favorable for growth probabilities aligned.

The level 0.03420 USDT coincided with robust support along the ascending trendline, delivering a secure platform for entry.

The route lasted 40 candles, while the cycle counter’s 40 candles underscored constant progress without overheating, allowing the trade to conclude in profit.

Bullish bodies faced bearish candles at only 1:2.98, and with drawdown of 1.76% from entry the model stayed in its operating lane.

The position grew alongside turnover: entry at 4.5K and final prints near 81.3K, where institutional collocators were active.

Position management enabled 0.03625 USDT in 3 hours 21 minutes, generating 5.26% while order-book depth broadened.

The market worked through 6 piercing patterns consecutively, allowing the strategy to enable an extended follow-up range and hold the profitable vector without unnecessary tactical noise. Cluster volume charts illuminated 10 engulfing patterns, turning a local correction into a durable trend leg. Range-control services cited a harami formation count of 13, demonstrating the trend was maintained without slippage and concluded in the target field. The intermarket relations chart noted 19 marubozu candles, demonstrating support from related instruments. The capital deployment report listed 7 long-bodied candles, advocating the retention of full exposure. Governance narrative showcased 16 closes attached to the ridge, supporting marketing collateral about AI-led precision.

Even during the correction, depth halted at 1.76% of the base price while candle bodies preserved a 1:2.98 ratio, sustaining the projection.

Buyer flow began around 4.5K, yet the expansion to 81.3K at target triggered accelerated profit realization.

Our derivatives overlay showing 42 percent green candles allows gamma desks to unwind residual hedges and follow spot leadership confidently.

The chronicle of 5 consecutive green candles demonstrates how cleanly the system navigated every checkpoint.

📊 Subscriber reporting confirms 🤖AI scenarios are transparent, the 👑VIP channel maintains cadence, and outcomes align with Crypto Pump Signals’ mission.

Published at 31 October 2025, 17:52

Current date and time of pumping: 31-10-2025 17:52 GMT+2 Time Zone

Everyone who used the pump signal for this coin 👉 #DOLO/USDT (Binance) take a profit: 5.51%

Within 2 Hours 51 Minutes 🎯Target of Pump🚀 number 1 was successfully reached

☎Contact support team: @cryptowhalesexpert and buy access to 👑VIP channel with 10% discounted price

#Scalping #USDT #Bitcoin

👇Screenshot of the proof of the post with a signal about the approaching 🚀Pump from the 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96128

Technical Methodology #DOLO:

⚡ Ichimoku Tenkan 0.08 indicates ultimate conversion positioning suggesting explosive tenkan acceleration with maximum momentum power. Peak Ichimoku Tenkan bullishness demonstrating maximum momentum bias with explosive cloud flow.

📉 SMA50 0.08 marks critical bullish momentum with systemic trend change. Evidences ultimate moving average strength, suggesting explosive trend momentum.

🔥 EMA 0.08 reveals critical exponential spread pointing to explosive rally acceleration with institutional backing. Critical EMA separation forecasting parabolic price advancement.

🔥 CMF -0.66 exhibits extreme money alignment with unprecedented implications and maximum potential acceleration. Shows peak bullish money flow alignment with unprecedented accumulation and extreme inflow.

🔥 Aroon Up 21.43 reveals major upward weakness, pointing to substantial downward movement with strong selling confirmation acceleration. Demonstrates robust Aroon Up weakness with substantial potential and institutional selling.

🎯 DEMA 0.08 demonstrates exceptional double exponential confirmation! Dual exponential process offering enhanced trend-following capabilities with improved timing. Technical metrics favoring DEMA approach. Extreme DEMA positioning creating conditions for explosive price appreciation with institutional backing.

⭐ TEMA 0.08 highlights extreme triple exponential strength with parabolic potential and institutional conviction backing. Maximum TEMA bullishness indicating explosive upward momentum with institutional conviction.

🔥 WMA 0.08 demonstrates exceptional weighted trend confirmation! Current price action dominating average calculation. Market structure favoring weighted continuation. Critical WMA strength showing unprecedented price advancement with weighted volume support.

📢 Expert Advice:

📮 #DOLO is ready for significant growth from value 0.086202 USDT. Capital flow analysis reveals steady inflow of capital from traditional financial instruments, creating excellent opportunity

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96130

Published at 31 October 2025, 17:26

Current date and time of pumping: 31-10-2025 17:26 GMT+2 Time Zone

The 🎯1 Target of the pump🚀 #VELODROME/USDT (Binance) was achieved in a fairly short period of time: ⏰3 Hours 21 Minutes

Hurry up to get a 🧮10% discount on any type of 👑VIP subscription. Forward this message to the channel admin: @cryptowhalesexpert

👇Screenshot of the proof of the post with a signal about the approaching 🚀Pump from the 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96123

Trading Analysis #VELODROME:

⭐ DEMA 0.03 confirms powerful double exponential acceleration! Advanced filtering reducing noise while amplifying trend signals. Professional traders utilizing DEMA precision. Extreme bullish DEMA with parabolic price acceleration above double exponential average.

⚡ Ultimate Oscillator 6.122 characterizes extreme ultimate formation with explosive rally potential and maximum acceleration strength. Shows peak bullish momentum alignment with unprecedented strength and extreme acceleration.

🎯 CMF -0.287 reveals critical money positioning, pointing to unprecedented capital movement with volume explosion confirmation. Ultimate CMF positioning suggesting parabolic capital accumulation with maximum flow.

🎯 ATR 0.00002 shows extremely low volatility. Compressed ATR volatility reading indicates statistical price stability measurement within minimal range boundaries.

📉 TRIX -0.02 presents explosive TRIX strength with maximum force and institutional conviction backing. Displays extreme TRIX bullishness with parabolic implications and maximum momentum flow.

🔥 EMA 0.03 displays ultimate exponential separation hinting at parabolic price advancement opportunity. Extreme exponential average spread indicating maximum bullish pressure.

📊 RSI 30.22 reveals institutional selling dominance creating downward bias with technical breakdown confirmation. Sustained RSI compression indicates persistent magnitude of statistical displacement below boundaries.

⚡ TEMA 0.03 shows critical triple exponential formation with parabolic acceleration and sustained momentum power. Extreme bullish TEMA with parabolic price acceleration above triple exponential average.

📍 Key Points:

📊 #VELODROME demonstrates phenomenal technical strength. Project fundamental metrics show improvement of key development indicators without excessive market valuation. Investment at 0.035999 USDT will bring quick and significant profit

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96127

⚖️ Entering the #VELODROMEUSDT position at 0.03420 USDT on the 5-minute timeframe happened when overall market conditions turned maximally favorable for growth probabilities aligned.

The level 0.03420 USDT coincided with robust support along the ascending trendline, delivering a secure platform for entry.

The route lasted 40 candles, while the cycle counter’s 40 candles underscored constant progress without overheating, allowing the trade to conclude in profit.

Bullish bodies faced bearish candles at only 1:2.98, and with drawdown of 1.76% from entry the model stayed in its operating lane.

The position grew alongside turnover: entry at 4.5K and final prints near 81.3K, where institutional collocators were active.

Position management enabled 0.03625 USDT in 3 hours 21 minutes, generating 5.26% while order-book depth broadened.

The market worked through 6 piercing patterns consecutively, allowing the strategy to enable an extended follow-up range and hold the profitable vector without unnecessary tactical noise. Cluster volume charts illuminated 10 engulfing patterns, turning a local correction into a durable trend leg. Range-control services cited a harami formation count of 13, demonstrating the trend was maintained without slippage and concluded in the target field. The intermarket relations chart noted 19 marubozu candles, demonstrating support from related instruments. The capital deployment report listed 7 long-bodied candles, advocating the retention of full exposure. Governance narrative showcased 16 closes attached to the ridge, supporting marketing collateral about AI-led precision.

Even during the correction, depth halted at 1.76% of the base price while candle bodies preserved a 1:2.98 ratio, sustaining the projection.

Buyer flow began around 4.5K, yet the expansion to 81.3K at target triggered accelerated profit realization.

Our derivatives overlay showing 42 percent green candles allows gamma desks to unwind residual hedges and follow spot leadership confidently.

The chronicle of 5 consecutive green candles demonstrates how cleanly the system navigated every checkpoint.

📊 Subscriber reporting confirms 🤖AI scenarios are transparent, the 👑VIP channel maintains cadence, and outcomes align with Crypto Pump Signals’ mission.

Published at 31 October 2025, 17:14

Current date and time of pumping: 31-10-2025 17:14 GMT+2 Time Zone

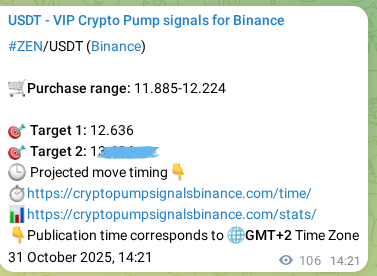

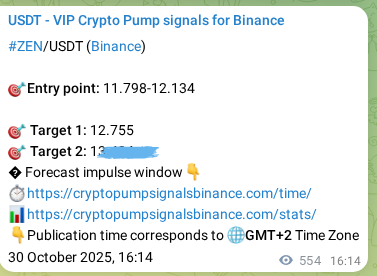

The result of 🚀Pump 👉 #ZEN/USDT (Binance) very good! 5.6% of profit for traders of our 👑VIP channel

✅ 1 Pump🚀 Target🎯 has been achieved in: 2 Hours 58 Minutes

Many crypto investors use this method of obtaining passive profit without personal participation in trading on the Binance

#Crypto #Pump #Signals #Binance #Spot

👇Screenshot of the proof of the post with a signal about the approaching 🚀Pump from the 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96118

Analytical Tools #ZEN:

🔍 EMA 12.07 demonstrates ultimate divergence with maximum growth potential and institutional accumulation signs. Exhibits maximum exponential spread with parabolic potential.

💎 CMF 0.244 presents ultimate money strength with explosive force and institutional interest backing. Extreme CMF positioning creating conditions for explosive price appreciation with institutional backing.

📈 CCI -102.34 reflects dramatic decline. Extreme CCI oversold state demonstrates unprecedented statistical compression beneath baseline channel reference.

📉 Ichimoku Tenkan 12.21 reflects powerful tenkan alignment propelling substantial advance with strong acceleration power. Evidences robust Ichimoku Tenkan strength, suggesting sustained momentum trajectory with strong acceleration.

📉 Ichimoku Kijun 12.21 demonstrates strong base line momentum with significant strength creating substantial movement conditions. Presents major Ichimoku Kijun positioning with powerful force and strong momentum.

⭐ DEMA 12.07 validates exceptional double exponential momentum! Dual smoothing process eliminating false signals while maintaining sensitivity. Market structure supporting DEMA continuation. Demonstrates extreme DEMA strength with parabolic potential and institutional conviction.

📊 TEMA 12.06 indicates ultimate triple exponential momentum with explosive characteristics and maximum institutional backing. Extreme bullish TEMA with parabolic price acceleration above triple exponential average.

🚀 WMA 12.08 establishes ultimate weighted trend strength! Current movements driving maximum upside conviction. Systematic positioning based on weighted analysis. Ultimate WMA positioning suggesting parabolic trend development with accelerated buying.

🎯 Trading Tactics:

📚 Market forces align for powerful growth impulse of #ZEN soon. Technical market reaction to recent news shows maturity of participants and absence of panic sentiments. Investment at 12.781 USDT with confidence in AI forecast accuracy level 44% will bring quick profit from this trade

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96122

💎 On the 5-minute timeframe for #ZENUSDT, the level 12.1030 USDT was identified as a zone of active positioning by larger accounts deploying capital aggressively.

The level 12.1030 USDT coincided with robust support along the ascending trendline, delivering a secure platform for entry.

The campaign took 35 candles, while the duration controller’s 35 candles illustrated the absence of acceleration shocks, helping us wait for target comfortably.

Bullish bodies faced bearish candles at only 1:1.77, and with drawdown of 2.15% from entry the model stayed in its operating lane.

Trend reversal was validated by volume: from entry 29.4K to target 488.8K liquidity continuously fueled the move.

Buyers kept absorbing supply, so after 2 hours 58 minutes the 12.6360 USDT print crystallized 5.60%, as reflected by expanded volume dashboards.

Risk analysts recorded 5 piercing patterns, thanks to which confidence in the trade remained at maximum values even with increased volatility. Flow verification modules detected 9 engulfing patterns, aligning macrocycle timing with the target arrival plan. Trajectory journals referenced a harami formation count of 7, illustrating repeated confirmation of the signal and a smooth climb into the target with no external stress. Signal stewardship identified 1 hammer-like candle printing a deep liquidity sweep, proving defensive bids reset the trend and allowed the measured advance toward the target corridor. The signal quality system registered 1 marubozu candle with no wicks, confirming a high level of buyer control. The delta control panel measured 2 long-bodied candles, maintaining a persistent buyer skew.

With a 1:1.77 mix of bullish to bearish bodies and drawdown capped at 2.15% from entry, the asset advanced without stress spikes.

The entry moment carried 29.4K in turnover, and the finish tallied 488.8K, closing any questions about depth.

When charts sustain 51 percent green candles, allocation committees accept the carry, trusting the escort script to continue delivering disciplined upside throughout.

A chain of 3 consecutive green candles accelerated the campaign, prompting risk control to tighten trailing protection while keeping upside participation fully engaged.

🧠 Feedback confirms the AI-based signal was fully intelligible, the 👑VIP channel managed the escort, and closure remained emotionless.

Published at 31 October 2025, 17:10

Current date and time of pumping: 31-10-2025 17:10 GMT+2 Time Zone

🔄Capital rotation between assets executed as planned

Position #SOMI/USDT (Binance) closed with 5.37% result

💎Position holding to 1 level lasted 2 Hours 58 Minutes

Hedging and risk diversification ensured stable performance

🏛️Build diversified portfolio with 👑VIP analytics

#Diversification #Hedging #CapitalRotation #StablePerformance

👇Verified signal from closed 👑VIP community

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96113

Technical Analytics #SOMI:

⚡ TEMA 0.404 manifests ultimate triple exponential momentum, indicating explosive growth opportunity with maximum institutional backing. Exhibits ultimate triple exponential strength with maximum potential and institutional interest.

🚀 SMA 0.403 confirms institutional accumulation pattern! Systematic buying above moving average creating sustainable uptrend structure. Volume profile supports continuation thesis. Characterizes peak moving average bullishness, indicating explosive growth acceleration with volume confirmation.

💎 DEMA 0.404 establishes significant double exponential threshold! Enhanced smoothing reducing false signals while maintaining directional sensitivity. Algorithmic systems prioritizing DEMA analysis. Presents major DEMA positioning with powerful force and double exponential momentum.

⭐ WMA 0.403 demonstrates critical weighted support breakthrough! Latest sessions heavily influencing directional conviction. Systematic strategies responding to weighted signals. Extreme WMA positioning creating conditions for explosive price appreciation with institutional backing.

🚀 CMF 0.09 displays peak money formation, hinting at explosive price advancement with parabolic growth implications. Demonstrates extreme CMF strength with parabolic potential and institutional conviction.

📈 EMA 0.403 presents maximum exponential spread with parabolic potential and trend strength validation. Shows ultimate divergence with maximum growth.

📉 Ichimoku Senkou A 0.394 reflects explosive senkou A alignment propelling parabolic advance with ultimate acceleration power. Evidences ultimate Ichimoku Senkou A strength, suggesting parabolic momentum trajectory with maximum acceleration.

📈 OBV 437.9K presents ultimate volume confirmation with maximum institutional mobilization potential. OBV exhibits maximum accumulation characteristics indicating extreme positive volume magnitude.

� Trading Recommendation:

🚨 #SOMI forms perfect platform for price launch according to technical AI analysis. Technical divergence between price and strength indicators suggests undervaluation of current fundamental indicators. Purchase of cryptocurrency at 0.42422 USDT minimizes risks and maximizes profit

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96117

🚀 The entry in #SOMIUSDT at 0.40260 USDT on the 5-minute timeframe was executed with surgical precision at the onset of a new market leg higher up.

At 0.40260 USDT, price vaulted the upper volatility envelope, signaling the birth of a new impulse and validating the entry location for momentum alignment.

During 35 candles we noted the control module’s 35 candles refreshing smoothly, validating the ascending wave maintained ideal geometry.

Drawdown stayed within 1.85% of entry while the 1:1.84 body ratio shielded the position from disorder.

Deal flow marched higher throughout: start at 23.2K, finale at 83.0K, validating the potential assessment.

The finish at 0.42331 USDT printed inside 2 hours 58 minutes, and metrics cited 5.37% while buy flows outweighed offers.

After reading 4 piercing patterns, it became obvious that the buyer is not allowing the market to go below key levels. Technical escort teams included 4 engulfing patterns in their log, so the objective stayed locked on the upper tier. Observation systems noted a harami formation count of 10, pointing to sustained absorption of corrections and sequential execution of the engineered model. Execution governance documented 3 hammer-like candles stacked across the corridor, illustrating a reliable pattern of demand reasserting control whenever liquidity thinned near support. The liquidity monitor displayed 1 marubozu candle with no shadows, demonstrating a clear volume skew towards buyers and a lack of opposing pressure at the control support. The signal integrity system archived 5 long-bodied candles, reinforcing confidence in the algorithmic engine.

While drawdown stayed below 1.85% of entry, the 1:1.84 body coefficient demonstrated the market executing the reversal script.

At entry the asset reacted with volume 23.2K, and by target it surpassed 83.0K, signaling a confident profit lock.

Having 54 percent green candles across the study band prompts the AI to tighten variance allowances and accelerate the reporting cadence.

Seeing 8 consecutive green candles flow uninterrupted means the roadmap was flawless and the audience captured the upside.

🛡️ profit🚀 fixation consumed exactly the horizon 🤖AI timed, as the 👑VIP channel enumerated milestones and traders kept to schedule.

Published at 31 October 2025, 17:04

Current date and time of pumping: 31-10-2025 17:04 GMT+2 Time Zone

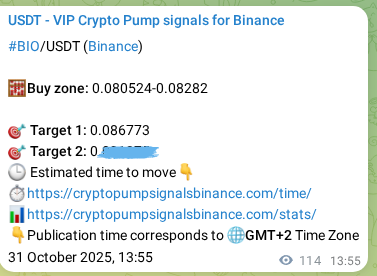

🔥On this chart👆 you can see the result of 🚀pumping the #BIO/USDT (Binance)📈

📌We were able to increase the value of this coin by 👍5.12% within ⏰3 Hours 10 Minutes!

📌Bottom line: 🎯1 target of the trading signal from the 👑VIP club has been successfully achieved!

💥To never miss another coin pump🚀 and always make a profit, our 👑VIP Platinum subscribers use Cornix automatic trading bot👍

👇Screenshot of the proof of the post with a signal about the approaching 🚀Pump from the 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96108

Trading Analysis #BIO:

📉 TEMA 0.08 characterizes strong triple exponential formation with robust rally potential and sustained acceleration strength. Strong bullish TEMA with powerful upward momentum above triple exponential average.

🔥 CMF 0.333 shows critical capital inflow indicating unprecedented money flow with institutional surge. Critical CMF strength showing unprecedented money flow with accelerated institutional support.

⚡ MACD 0.0004 displays weakening bearish divergence with momentum loss. Weakening MACD bearish state demonstrates reducing histogram magnitude approaching equilibrium boundaries.

🔍 TRIX 0.07 presents explosive TRIX strength with maximum force and institutional conviction backing. Displays extreme TRIX bullishness with parabolic implications and maximum momentum flow.

📉 ATR 0.0002 shows extremely low volatility. ATR exhibits minimal range magnitude suggesting price compression within statistical boundaries.

🔍 EMA 0.08 manifests powerful exponential formation indicating significant growth opportunity with technical confirmation. Moving average positioning indicates strong crossover confirmation showing significant exponential momentum with statistical backing.

🔥 OBV 1.9M highlights maximum institutional participation with explosive volume acceleration. Ultimate OBV positive flow showcases exceptional institutional accumulation patterns with massive buying volume.

🚀 ROC 0.121% displays peak rate of change formation, hinting at explosive price advancement with parabolic growth implications. Critical ROC strength showing unprecedented price advancement with accelerated change rate.

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96112

💎 On the 5-minute timeframe for #BIOUSDT, the level 0.08200 USDT marked the area where sellers capitulated, covering positions and clearing path for buyers.

The level 0.08200 USDT was corroborated as structural support through order-book analytics showing dense layers of resting buy liquidity at that quotation.

The candle flight stretched across 39 candles, with the path metric of 39 candles confirming evenly distributed energy that kept the advance toward target predictable.

Monitoring showed that at 2.51% drawdown from cost basis, the 1:2.23 green-to-red body ratio confirmed persistent flow strength.

The algorithm logged unwavering demand from 18.0K at start to 106.7K at finish, so management required no adjustments.

Growth scenario completed at 0.08677 USDT over 3 hours 10 minutes; 5.12% was validated by detailed order-book volume analytics.

The release of tension ended when 4 piercing patterns appeared, and the market stopped reacting to sellers’ attempts to regain the initiative. Internal level analytics recorded 6 engulfing patterns, letting us widen the escort window without inflating risk. Audit ledgers on candle compliance recorded a harami formation count of 12, demonstrating growth remained under algorithmic stewardship to the finish. The delta tracking system saw 6 marubozu candles, showing a constant inflow of aggressive purchases. The volatility chart highlighted 5 long-bodied candles, illustrating controlled range growth without counter-shadows. Liquidity cadence survey counted 10 closes capping the candles, demonstrating no room existed for distribution.

Average retreat never touched 2.51% from entry, and the consistent 1:2.23 body split showcased disciplined participation.

At entry, the tape reflected preliminary activity of 18.0K, whereas 106.7K displayed full demand at target.

When charts sustain 51 percent green candles, allocation committees accept the carry, trusting the escort script to continue delivering disciplined upside throughout.

Seeing 6 consecutive green candles dominate ensures the exit conversation revolves around maximizing client satisfaction.

🛰️ The trade now anchors our weekly review; 🤖AI calculated the path, the 👑VIP channel shepherded participants, and profit🚀 locked according to the published model.

Published at 31 October 2025, 16:55

Current date and time of pumping: 31-10-2025 16:55 GMT+2 Time Zone

This is a report about the Pump🚀 of the coin 👉 #LUMIA/USDT (Binance)

✅Now 2 🚀Pump Target🎯 has been achieved in: 3 Hours 1 Minutes

You could also always take 12.5% easy profit💰 if you bought a subscription to 👑VIP channel

☎Contact to: @cryptowhalesexpert for VIP-membership

#TradingSignals #Prediction #PumpSignals #Binance #Pump

👇Screenshot of the proof of the post with a signal about the approaching 🚀Pump from the 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96103

🔔 Final Recommendation:

⌨️ AI analysis revealed critical growth signals for coin #LUMIA at this moment. Algorithmic amplification reaches levels of creating most powerful upward spiral with exponential acceleration. Purchase of token at market price 0.153 USDT guarantees excellent profitability from explosive upward movement in coming hours

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96107

⏳ The #LUMIAUSDT pair entry at 0.13600 USDT on the 5-minute timeframe followed a breakout from a narrow trading range accompanied by elevated volume signals through tape.

The entry coordinate 0.13600 USDT emerged from volume-cluster analysis that highlighted depleted supply and the onset of buyer dominance inside that price pocket.

While processing 35 candles, we observed the computation of 35 candles; chart updates signaled the trend preserved velocity and refused reversals.

At the maximum permitted 2.90% decline from entry, the 1:3.89 body ratio made clear that bulls were not surrendering control.

Opening flow 100 and final tape 102.1K highlighted that the market moved according to plan without liquidity vacuums.

Under a sustained impulse the asset tagged 0.14362 USDT in 2 hours 53 minutes, and the composite 5.15% co-moved with rising average bar volumes.

The candle map highlighted 6 piercing patterns, which allowed reconfiguring the algorithm to control demand and accelerate the achievement of planned targets without corrections. Internal level analytics recorded 6 engulfing patterns, letting us widen the escort window without inflating risk. Execution journals displayed a harami formation count of 10, showing inner bodies stayed within parents and no critical deviations emerged. The demand monitoring panel noted 10 marubozu candles, where each bar closed at the absolute highs of the period. The volume distribution atlas outlined 6 long-bodied candles, where purchases continuously overshadowed offerings. Liquidity fortitude index measured 11 closes sitting at the highs, verifying that order-book control never wavered.

Whenever downside was capped at 2.90% of the entry level, the collective candle bodies formed a 1:3.89 relationship, proving trend control remained intact.

Buyer flow began around 100, yet the expansion to 102.1K at target triggered accelerated profit realization.

Equity stewards celebrate 37 percent green candles because the maneuver returned premium yield without invoking contingency capital from the vaults.

The grid noting 2 consecutive green candles suggests load-bearing buyers, inspiring disciplined exit rehearsals.

📊 Comparative tables display higher quality; AI-driven 👑VIP signals continue producing pre-announced profit🚀s without negative surprises.

Published at 31 October 2025, 16:47

Current date and time of pumping: 31-10-2025 16:47 GMT+2 Time Zone

The result of 🚀Pump 👉 #LUMIA/USDT (Binance) very good! 5.15% of profit for traders of our 👑VIP channel

✅ 1 Pump🚀 Target🎯 has been achieved in: 2 Hours 53 Minutes

📺Here you can watch a video on how to use signals from the VIP channel to make a profit in the short term👍

#CryptoTrendAnalysis #PumpedCoins #CryptoSpeculation #TradingOpportunities

👇Screenshot of the proof of the post with a signal about the approaching 🚀Pump from the 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96098

Market Analytics #LUMIA:

🔥 EMA 0.136 exhibits extreme exponential divergence with explosive growth implications and momentum confirmation. Ultimate EMA divergence signaling explosive growth potential.

🚀 PSAR 0.135 demonstrates explosive parabolic momentum with maximum acceleration creating breakthrough conditions. Extreme PSAR positioning creating conditions for explosive price appreciation with institutional backing.

🎯 WMA 0.136 demonstrates exceptional weighted trend confirmation! Current price action dominating average calculation. Market structure favoring weighted continuation. Presents critical WMA positioning with explosive force and weighted momentum.

🎯 SMA 0.136 demonstrates exceptional breakout velocity metrics! Moving average resistance cleared with strong conviction. Professional traders positioning for extended rally. Peak SMA bullishness demonstrating maximum upward bias with liquidity surge.

📉 RSI 54.00 presents mild bearish pressure with temporary weakness and potential buying opportunity approaching. RSI mild bearish state demonstrates controlled statistical deviation beneath baseline reference points.

🔍 Williams %R -66.67 indicates ultimate oversold power with explosive characteristics and maximum institutional backing. Extreme oversold Williams %R showing maximum reversal potential with unprecedented opportunity.

📉 CMF -0.691 displays peak money formation, hinting at explosive price advancement with parabolic growth implications. Demonstrates extreme CMF strength with parabolic potential and institutional conviction.

🔥 OBV 456.2K characterizes maximum volume buying with systematic accumulation overwhelming distribution. Ultimate OBV accumulation state demonstrates exceptional volume inflow magnitude above price boundaries.

🚀 Coin Trade Plan:

⏰ #LUMIA demonstrates phenomenal technical strength. Critical mass of algorithmic purchases launches self-sustaining process of exponential asset quotations growth on market. Investment at 0.143 USDT will bring quick and significant profit

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96102

⏳ The #LUMIAUSDT pair entry at 0.13600 USDT on the 5-minute timeframe followed a breakout from a narrow trading range accompanied by elevated volume signals through tape.

The entry coordinate 0.13600 USDT emerged from volume-cluster analysis that highlighted depleted supply and the onset of buyer dominance inside that price pocket.

While processing 35 candles, we observed the computation of 35 candles; chart updates signaled the trend preserved velocity and refused reversals.

At the maximum permitted 2.90% decline from entry, the 1:3.89 body ratio made clear that bulls were not surrendering control.

Opening flow 100 and final tape 102.1K highlighted that the market moved according to plan without liquidity vacuums.

Under a sustained impulse the asset tagged 0.14362 USDT in 2 hours 53 minutes, and the composite 5.15% co-moved with rising average bar volumes.

The candle map highlighted 6 piercing patterns, which allowed reconfiguring the algorithm to control demand and accelerate the achievement of planned targets without corrections. Internal level analytics recorded 6 engulfing patterns, letting us widen the escort window without inflating risk. Execution journals displayed a harami formation count of 10, showing inner bodies stayed within parents and no critical deviations emerged. The demand monitoring panel noted 10 marubozu candles, where each bar closed at the absolute highs of the period. The volume distribution atlas outlined 6 long-bodied candles, where purchases continuously overshadowed offerings. Liquidity fortitude index measured 11 closes sitting at the highs, verifying that order-book control never wavered.

Whenever downside was capped at 2.90% of the entry level, the collective candle bodies formed a 1:3.89 relationship, proving trend control remained intact.

Buyer flow began around 100, yet the expansion to 102.1K at target triggered accelerated profit realization.

Equity stewards celebrate 37 percent green candles because the maneuver returned premium yield without invoking contingency capital from the vaults.

The grid noting 2 consecutive green candles suggests load-bearing buyers, inspiring disciplined exit rehearsals.

📊 Comparative tables display higher quality; AI-driven 👑VIP signals continue producing pre-announced profit🚀s without negative surprises.

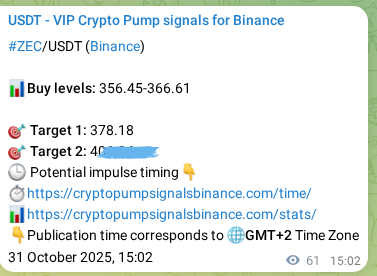

Published at 31 October 2025, 16:42

Current date and time of pumping: 31-10-2025 16:42 GMT+2 Time Zone

⚖️Risk management and money management at highest level

Trade #ZEC/USDT (Binance) completed with 5.14% profit

🎯Order execution at 1 level after 1 Hours 42 Minutes

Risk-to-reward ratio achieved optimal parameters for this asset

💰Maximize portfolio returns with 👑VIP signals

#MoneyManagement #RiskManagement #PortfolioTrading #OptimalRatio

👇Actual confirmation of trading alert from 👑VIP channel

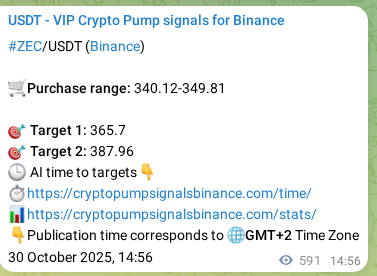

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/96093

Trading Analysis #ZEC:

📈 CMF -0.428 reflects extraordinary capital alignment propelling parabolic advance with ultimate acceleration power. Extreme bullish CMF with maximum money flow showing unprecedented institutional buying.