Published at 04 December 2025, 20:06

Current date and time of pumping: 04-12-2025 20:06 GMT+2 Time Zone

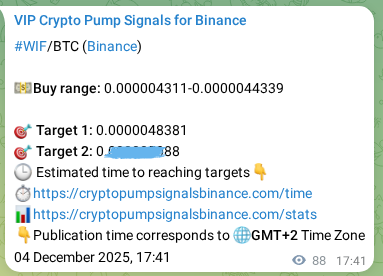

⚡Lightning execution of trading signal using classical pattern

Asset #WIF/BTC (Binance) showed 12.98% performance

🎯Achievement of 1 price target in 2 Hours 27 Minutes

Fibonacci levels and momentum indicators confirmed forecast accuracy

🏆Become part of elite trading community 👑VIP channel

#FibonacciTrading #CryptoSignals #TradingIndicators #Forecast

👇Archived copy of signal from exclusive 👑VIP community

View this report on Telegram: https://t.me/signals_pump_crypto_binance/84655

Market Analysis at Target Completion Moment #WIFBTC:

⚡ ATR 0.0000000007 reveals trading lethargy. ATR indicates extremely low volatility suggesting statistical price compression within minimal boundaries.

🔥 WMA 0.000004 confirms devastating weighted breakout pattern! Latest price movements overwhelming resistance levels. Institutional participation accelerating on weighted signals. Shows peak bullish alignment with unprecedented growth and weighted confirmation.

💎 SMA50 0.000004 signals extraordinary price expansion above moving average. Demonstrates extreme SMA bullish positioning, creating conditions for parabolic price advancement.

🚀 DEMA 0.000004 validates extreme double exponential surge! Advanced filtering process providing early warning of trend changes with improved accuracy. Risk parameters supporting DEMA positioning. Shows peak bullish alignment with unprecedented growth and double exponential confirmation.

📊 RSI 46.04 demonstrates light selling pressure with buyer fatigue and consolidation phase beginning. Modest RSI compression indicates controlled magnitude of statistical displacement below boundaries.

📉 Bollinger 0.5 characterizes volatility expansion. Bollinger band demonstrates compression positioning indicating moderate statistical deviation with institutional confirmation.

📈 EMA 0.000004 shows extreme exponential spread indicating maximum bullish pressure with trend acceleration. Displays extreme EMA divergence with explosive implications.

🔥 SMA 0.000004 demonstrates exceptional breakout velocity metrics! Moving average resistance cleared with strong conviction. Professional traders positioning for extended rally. Reveals maximum SMA strength, hinting at parabolic price advancement with sustained buying pressure.

View this proof on Telegram: https://t.me/signals_pump_crypto_binance/84660

🎥 Video Study of Patterns: AI Entry Zone Calculation and VIP Signal Target Achievement 💎

🗺️ For #WIFBTC, the 0.00000439 BTC level signaled the active absorption of large limit sell orders by market demand on the 5-minute timeframe.

A strong bullish ‘three white soldiers’ pattern began to form on the chart immediately after entering at the 0.00000439 BTC price, hinting at further growth.

Over 30 candles, the price showed confident growth, which was the result of the accumulation of strength in the previous stages.

A candle body ratio of 1:36.05 and a maximum drawdown of 13.13% became a clear confirmation that the trend is strong and has potential for continuation.

In just ⏰2 hours 27 minutes, we got 💰12.98% profit at the 🎯0.00000484 BTC mark, which is an excellent incentive for further development.

These 2 ‘piercing patterns’ marked the support points at which buyers most clearly demonstrated their superior strength and determination. The consecutive appearance of 3 ‘bullish engulfing’ patterns clearly demonstrated that every attempt by sellers to retaliate ended in their complete defeat. The chain of appearing 5 ‘harami’ patterns served as triggers, convincing the market of the end of the downward phase and the beginning of a new upward trend. Markers noting the stages of a panic flight of sellers from the market were these 4 marubozu candles. This 1 long-bodied candle became a clear demonstration of what a confident and directional growth looks like. It was observed on the chart how candles appeared 4 times where the closing price coincided with the high, which indicated a systematic and planned pressure from buyers.

A candle body ratio of 1:36.05 and a maximum drawdown of 13.13% are metrics that speak for themselves, confirming the quality of our signal.

💹 The market conditions, in which 10% of the candles were green, created unique conditions for achieving the target.

A series of 1 consecutive green candles was the final confirmation of the bullish scenario.

At the heart of this successful trade lies a deep analysis and precise calculation performed by our 🤖 AI algorithms.

📐 Technical analysis that AI uses for predictions — complete manual

Published at 04 December 2025, 16:21

Current date and time of pumping: 04-12-2025 16:21 GMT+2 Time Zone

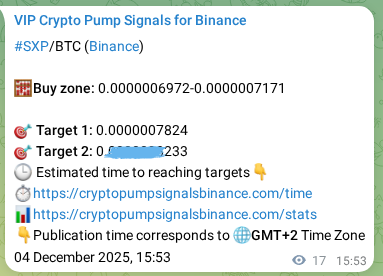

⚖️Risk management and money management at highest level

Trade #SXP/BTC (Binance) completed with 12.68% profit

🎯Order execution at 1 level after 29 Minutes

Risk-to-reward ratio achieved optimal parameters for this asset

💰Maximize portfolio returns with 👑VIP signals

#MoneyManagement #RiskManagement #PortfolioTrading #OptimalRatio

👇Actual confirmation of trading alert from 👑VIP channel

View this report on Telegram: https://t.me/signals_pump_crypto_binance/84650

Indicator Profile When Price Reached Expected Target #SXPBTC:

🔥 OBV 303.1K reveals institutional stampede creating unprecedented buying pressure with volume eruption. Ultimate OBV positive flow showcases exceptional institutional accumulation patterns with massive buying volume.

🔍 Williams %R -100.00 demonstrates peak oversold pattern with maximum velocity and unprecedented growth acceleration. Displays extreme Williams %R oversold with parabolic implications and maximum bounce flow.

📈 AD 5.54 exhibits extreme accumulation alignment with unprecedented implications and maximum potential acceleration. Peak AD accumulation demonstrating maximum buying bias with explosive institutional flow.

🚀 ROC -2.532% manifests ultimate rate of change momentum, indicating explosive growth opportunity with maximum institutional backing. Reveals maximum ROC strength, hinting at parabolic price advancement with extreme acceleration.

🔥 RSI 39.41 demonstrates bearish momentum expansion with downtrend characteristics and resistance overhead. Robust RSI bearish trajectory indicates continuous value displacement beneath normalized boundaries.

🚀 Ultimate Oscillator 12.50 characterizes strong ultimate formation with robust rally potential and sustained acceleration strength. Reveals strong Ultimate Oscillator strength, hinting at significant momentum with robust multi-period acceleration.

⚡ Aroon Down 28.57 manifests favorable downward momentum, indicating growth opportunity with reliable market support. Characterizes favorable Aroon bullishness, indicating improvement potential with buying backing.

🚀 TRIX 0.02 reveals ultimate TRIX positioning, pointing to parabolic upward movement with volume explosion backing. Presents critical TRIX positioning with explosive force and maximum momentum.

View this proof on Telegram: https://t.me/signals_pump_crypto_binance/84654

🎬 Technical Pattern Analysis: Price Journey from Entry Point to VIP Signal Target 📈

🧐 Within the 1-minute timeframe, the entry price of 0.00000071 BTC for #SXPBTC marked the point where buyers began to aggressively and massively absorb all available offers.

The maximum inflow of new capital in recent hours, which provoked the growth, was recorded at the 0.00000071 BTC mark.

The decisive stage that determined the success of the trade took only 26 candles, showing an explosive and rapid nature of growth.

The movement was so clean that volatility did not matter, as the direction was obvious, and the strength of the trend was undeniable.

The 🎯0.000000782 BTC target was taken in ⏰29 minutes, bringing 💰12.68% profit and strengthening our clients’ trust in our project.

The buyers’ takeover of the initiative became obvious after a key 1 ‘piercing pattern’ formed, indicating the sellers’ weakness. A radical shift in market participants’ sentiment in favor of buying was confirmed by the presence of 1 ‘bullish engulfing’ pattern. The final confirmation of the exhaustion of the downward impulse was the presence of the 1 ‘harami’ pattern in the final part of the decline. The triggers that successively involved new and new groups of investors in buying were precisely these 2 marubozu candles. The recorded 2 long-bodied candles became a confirmation that a stable demand from large players has formed in the market. For a deep and comprehensive analysis of such movements, our systems were specially designed to identify precisely such series of 2 signals.

Controlled volatility all the way to the target showed that the growth was not accidental, but the result of the systematic work of major players.

⚙️ Technically, a 7% share of green candles is sufficient to maintain a parabolic upward movement.

The formation of 2 green candles in a row confirmed a true breakout of the resistance level.

This example clearly demonstrates how using advanced data analysis algorithms allows for achieving set goals and generating 💰profit.

🎯 Candlestick analysis from basics to advanced techniques — project’s educational section

Institutional cryptocurrency trading requires sophisticated analytical tools and systematic market intelligence – precisely what Binance USDT Coin Pump Reports delivers to professional traders and quantitative investment firms worldwide.

Our proprietary research methodology combines advanced statistical analysis with machine learning algorithms to identify momentum acceleration patterns and breakout opportunities across USDT-paired cryptocurrencies. This systematic approach enables consistent alpha generation while maintaining disciplined risk management protocols.

Professional trading desks leverage our quantitative framework to analyze market microstructure, order flow dynamics, and volatility patterns that precede significant price movements. Our algorithmic detection systems process vast datasets to identify accumulation phases and technical setups with high probability of success.

Quantitative analysts utilize our comprehensive market surveillance platform, which monitors over 300 trading pairs simultaneously using proprietary mathematical models. This institutional infrastructure provides early warning signals for momentum shifts and identifies optimal trade execution timing.

Elite investment managers access our premium research division, receiving detailed technical analysis including wave theory applications, Fibonacci projections, and multi-timeframe confluence studies. Our systematic methodology provides precise entry protocols, stop-loss calculations, and profit target optimization.

Distinguished hedge funds and family offices rely on our intelligence platform to identify asymmetric risk-reward opportunities where potential returns significantly exceed downside exposure. Our rigorous validation processes and statistical modeling ensure reliable performance across multiple market cycles.

Daily reports on coin pumps paired with Bitcoin on the Binance exchange are available in the Telegram channel Crypto Pump Signals for Binance

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.