Stablecoins have a moment.

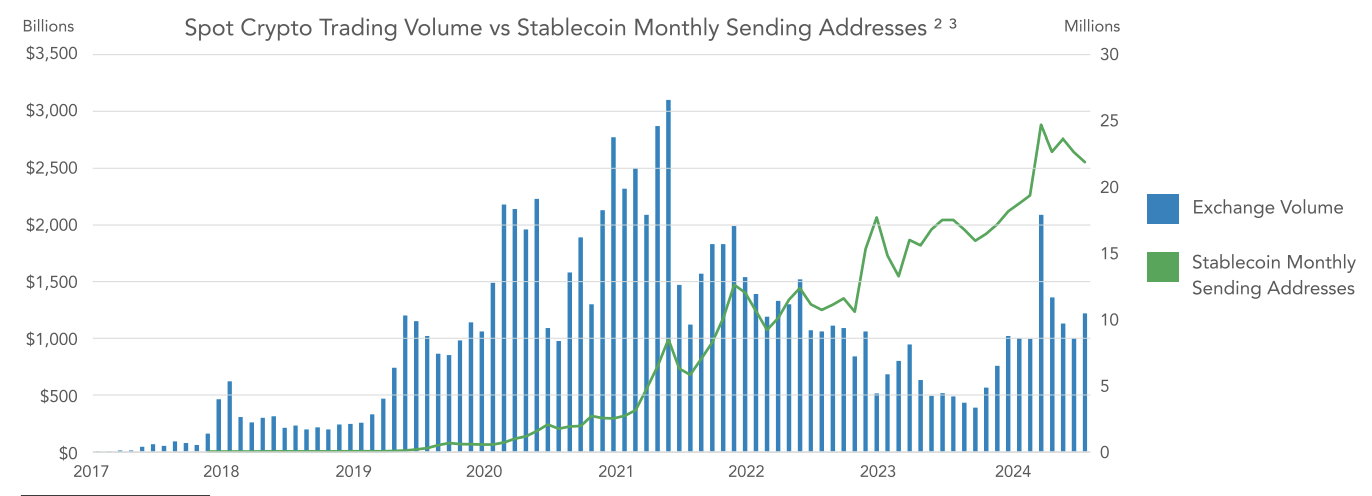

While the price of other crypto currencies has been in a downward trend, stablecoins have seen their market capitalization steadily increase. According to rwa.xzy it is now $170 million. However, there was a small dip in the last few days.

Castle Island Ventures along with Artemis, Visa, and Brevan Howard Digital conducted a survey to determine the popularity of stablecoins on certain emerging markets. This survey looked at approximately 2,500 cryptocurrency users from Nigeria, India Turkey Indonesia Brazil.

“Our survey results contradict the common belief that stablecoins are exclusively used as a tool for the speculative trading of crypto assets. Forty-seven percent of crypto users surveyed list saving in dollars as their stablecoin objective, 43% cited efficient currency conversion and 39% said yield generation. Gaining access to crypto exchanges remains the top use case for those surveyed, but a long tail or ordinary (non-crypto) economic activities is evident as well,” According to the report,

“The findings are clear: non-crypto uses account for a meaningful share of stablecoin usage modes in the countries surveyed.”

Nic Carter from Castle Island Ventures said to Blockworks that tracking data was of interest because he wanted a better understanding how stablecoins are used.

Carter will then take his findings back to Washington DC. Lawmakers and US officials have expressed their opinions about stablecoins. Kirsten Gilbrand and Cynthia Lummis are also pushing for regulations to be introduced around stablecoins.

“If you’re looking at emerging markets, this is a case of currency substitution where savings would be held in the naira or the Turkish lira or the Indian rupee, and it’s actually being converted into the dollar,” Carter explained.

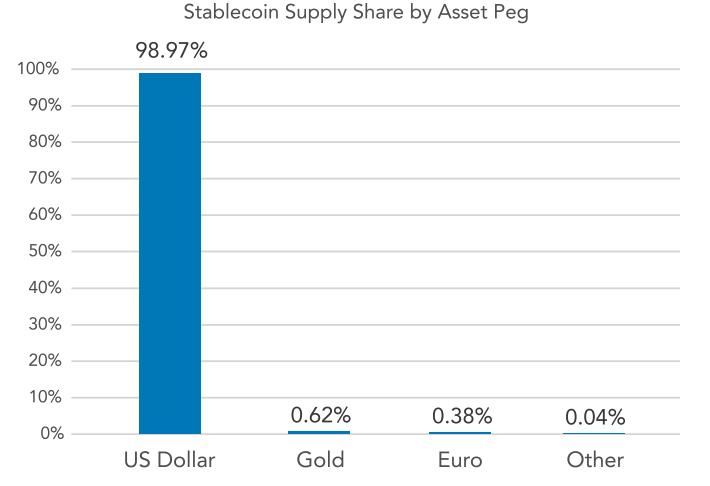

“So this is a positive buying pressure for the dollar and all the dollar assets that the stablecoin issuers hold (which are Treasurys). So my point is: This is a flow into the dollar. It’s a new source of demand. It’s very meaningful, and obviously it’s supportive of US interests.”

While it might impress US legislators, some in Nigeria may not be so pleased with the results. Nigeria has been hostile to crypto since the beginning of this year. Two Binance executives were detained (American Tigran Gamaryan remains in Nigeria) and Binance was charged with tax evasion, money laundering, and other crimes.

The data from this report suggests that Nigerian attempts to regulate its industry may not have been as successful. This survey was conducted from May through June of this year. Some onchain data were collected up until July. Nigeria detained Gambaryan towards the end of Febraury.

“Nigerians love stablecoins,” Carter noted. Carter noted. “paranoid,” Nigeria has topped every single category in the survey.

The country’s users “transact most frequently, stablecoins compose the largest share of respondent portfolios, they report the highest share of non-crypto-trading uses for stablecoins, and they maintain the highest self-reported knowledge of stablecoins,” The report said. The report stated that other countries, such as Turkey, had different uses of stablecoins.

“I think there actually is a crypto dollarization event happening in Nigeria, as far as I can tell, where people are actively deserting the naira and going to dollars via stablecoins. I think this is ongoing. It’s the first real crypto dollarization event,” Carter said to me.

He warned that he wasn’t sure whether you could “quantify that 15% of [naira’s] devaluation is due to crypto,” The survey was aimed at crypto users. The results suggest that Nigeria may have a valid reason to be concerned.

Nigeria aside, this study demonstrated that, stablecoins used by certain emerging market participants, can provide exposure to US dollars, allowing the US to benefit.

But, as stated above, there isn’t currently a regulatory framework for stablecoin issuers, even as Circle — the firm behind USDC — seeks to go public. Carter believes that issuers should be regulated. “stymied” They cannot issue stablecoins that bear interest.

“All of the interest bearing stablecoins, they’re issued overseas,” “, he added. Carter cited Paxos which, despite its US base, has a stablecoin that pays interest in Dubai. Mountain Protocol’s and Ethena’s offerings are both offshore.

“…I do think that the interest-bearing stablecoins will out-compete the ordinary ones at the margin with time. So they can’t do that in the US, because the [Securities and Exchange Commission] is so adamant that it makes it a security, right? So that’s one of the issues that’s…hobbled us for now,” Carter explained.

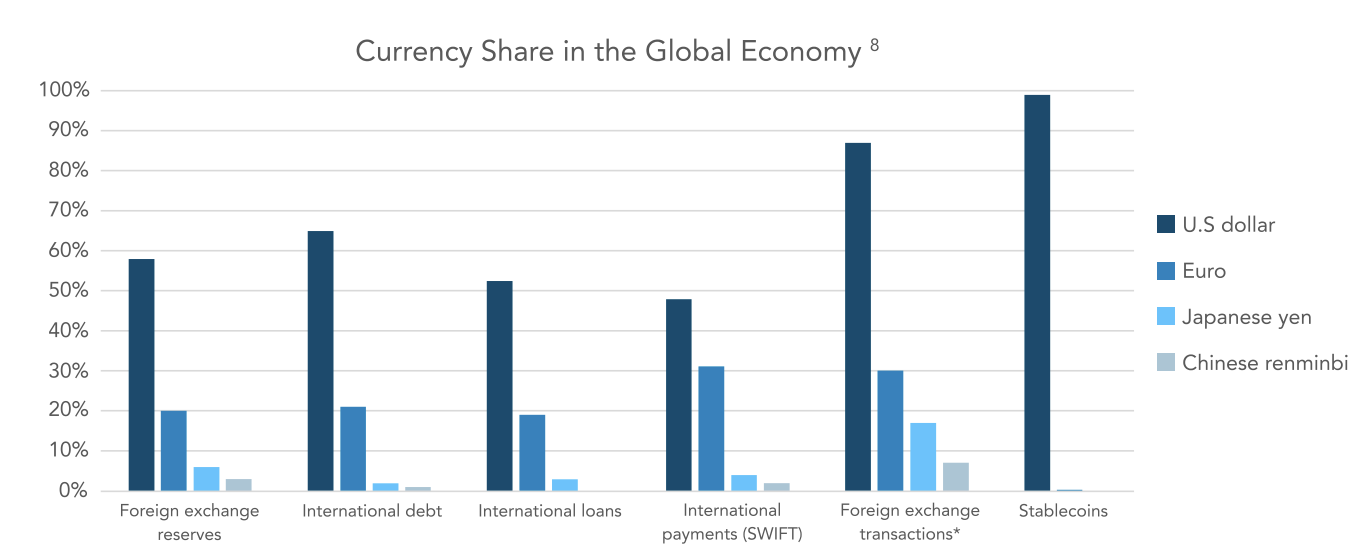

There is no single explanation for why stablecoins have been heavily dollarized, according to the report.

“The US dollar is the global reserve currency but in no other category of usage does it dominate to the same extent it does with stablecoins,” The point is made.

Stablecoins are a great idea. Time will tell whether the US takes advantage.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.