Unleashing artificial intelligence’s full potential to navigate the uncertain waters of cryptocurrency trading is like wielding an intricate compass on a stormy sea. In this article we delve into innovative strategies reshaping digital asset investment landscape and advanced methodologies redefining how traders anticipate short-term market dynamics through predictive analytics and machine learning algorithms; ushering in an age of precise trading where insight-driven decisions replace speculation-fueled guessing.

Discovering lucrative opportunities amid the chaos of cryptocurrency trading requires more than mere intuition; it requires an intricate grasp of emerging trends and an ability to discern patterns unseen to the naked eye. By employing AI-powered tools, investors gain a competitive edge, harnessing big data analysis’ power in spotting promising coins poised for impending price surges and providing investors with insight into cutting edge techniques – providing a glimpse of crypto trading’s future!

Navigating short-term fluctuations requires taking an informed, data-driven approach. Traditional trading strategies tend to falter against digital currency’s high degree of volatility; by tapping AI’s predictive abilities instead, traders can stay ahead of the game, capitalizing on fleeting opportunities with precision timing. With tools ranging from sentiment analysis and technical indicators at their disposal enabling investors to make educated decisions in real-time.

Gaining insights into cryptocurrency markets requires more than mere speculation; rather it necessitates taking an evidence-driven and innovative approach. This article serves as a beacon for those navigating digital asset trading’s ever-evolving landscape, offering insight into AI strategies’ transformative potential and providing guidance as the market matures; those equipped with tools and knowledge have an advantage when taking this investment approach into consideration.

How Artificial Intelligence can help cryptocurrency traders use market analysis and short-term profit forecasting in cryptocurrency trading?

In this section, we examine how artificial intelligence methods are being deployed for market analysis and short-term profits in cryptocurrency trading. AI algorithms enable traders to utilize sophisticated data analysis in order to anticipate market movements and capitalize on emerging opportunities for financial gain: this allows traders to maximize profits:

- Utilization of AI for Decision-Making: By harnessing AI insights gleaned from comprehensive market data analysis, traders are empowered with superior decision-making abilities. AI insights allow traders to identify emerging trends, assess market sentiment and position themselves for profit on fluctuations of cryptocurrency values.

- Real-Time Analysis: AI tools enable real-time monitoring of cryptocurrency markets, enabling traders to quickly adapt to changing market conditions and execute timely trades. By continuously processing vast volumes of data, these AI-powered tools give traders up-to-the-minute insight that enables agile decision-making based on market dynamics.

- Risk Mitigation: AI-powered forecasting models not only identify lucrative trading opportunities but can also mitigate market volatility risks through their analysis of historical data and trends. With AI algorithms accurately calculating potential trade risks for each trade, traders are better able to put into effect risk mitigation strategies and safeguard their investments.

- Automated Trading: AI-powered trading algorithms facilitate automating trade execution based on predefined parameters and market signals, eliminating human error and emotional bias while optimizing efficiency and capitalizing on fleeting market opportunities.

- Continuous Learning: AI algorithms are inherently adaptive, continuously gathering market information and improving their predictive abilities over time. Through machine learning algorithms, traders can take advantage of iterative improvements in prediction accuracy that improve their ability to anticipate market moves and tailor trading strategies accordingly.

- Competitive Advantage: By employing AI-powered market analysis and forecasting tools, traders gain an edge in the volatile cryptocurrency environment. Access real-time insights, manage risks effectively and execute trades quickly are essential skills necessary for success in an increasingly difficult cryptocurrency marketplace.

Artificial Intelligence techniques applied to market analysis and short-term profit forecasting has transformed cryptocurrency trading, giving traders powerful analytical tools and strategic insight for managing volatile markets while exploiting lucrative opportunities.

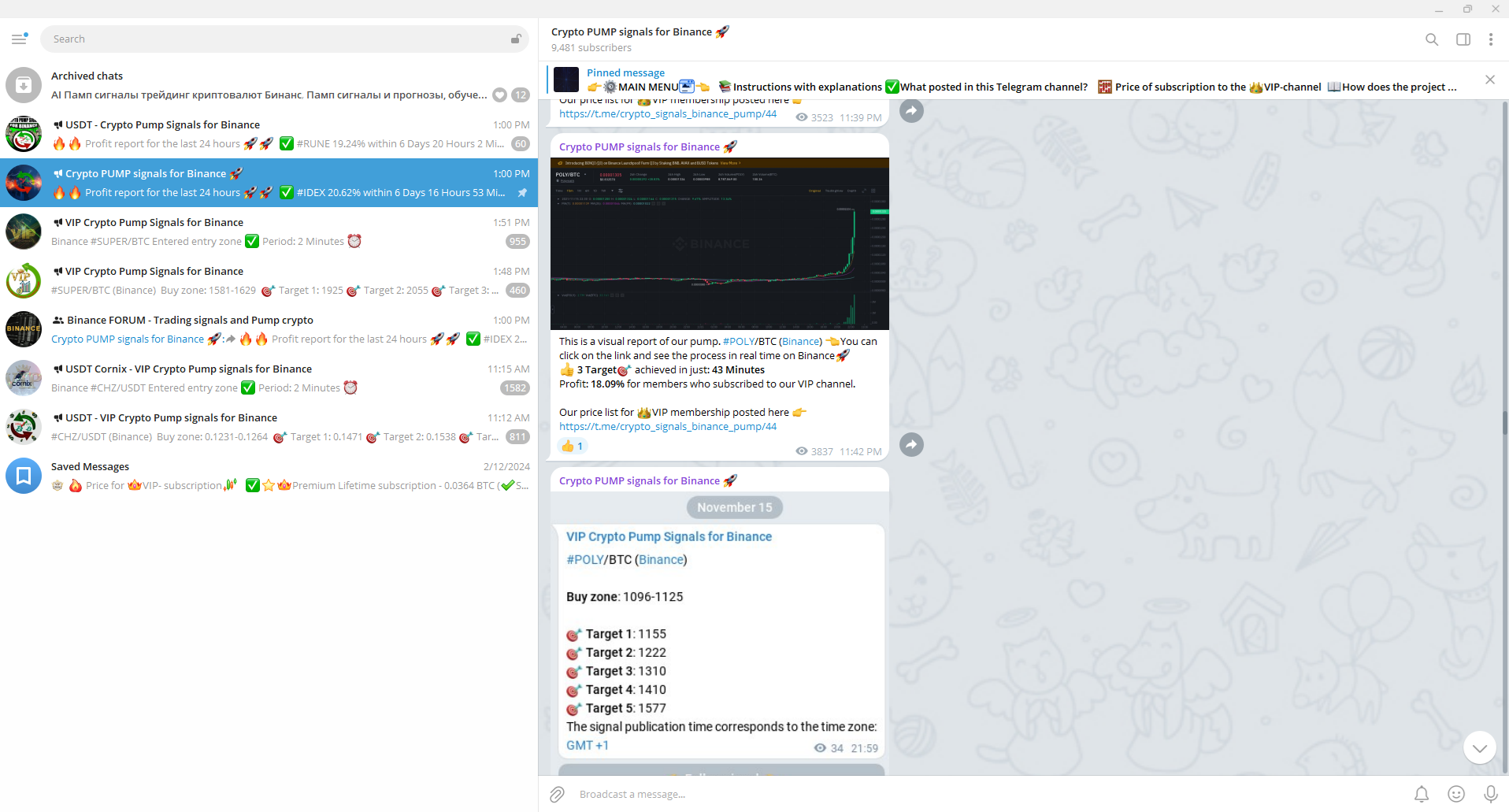

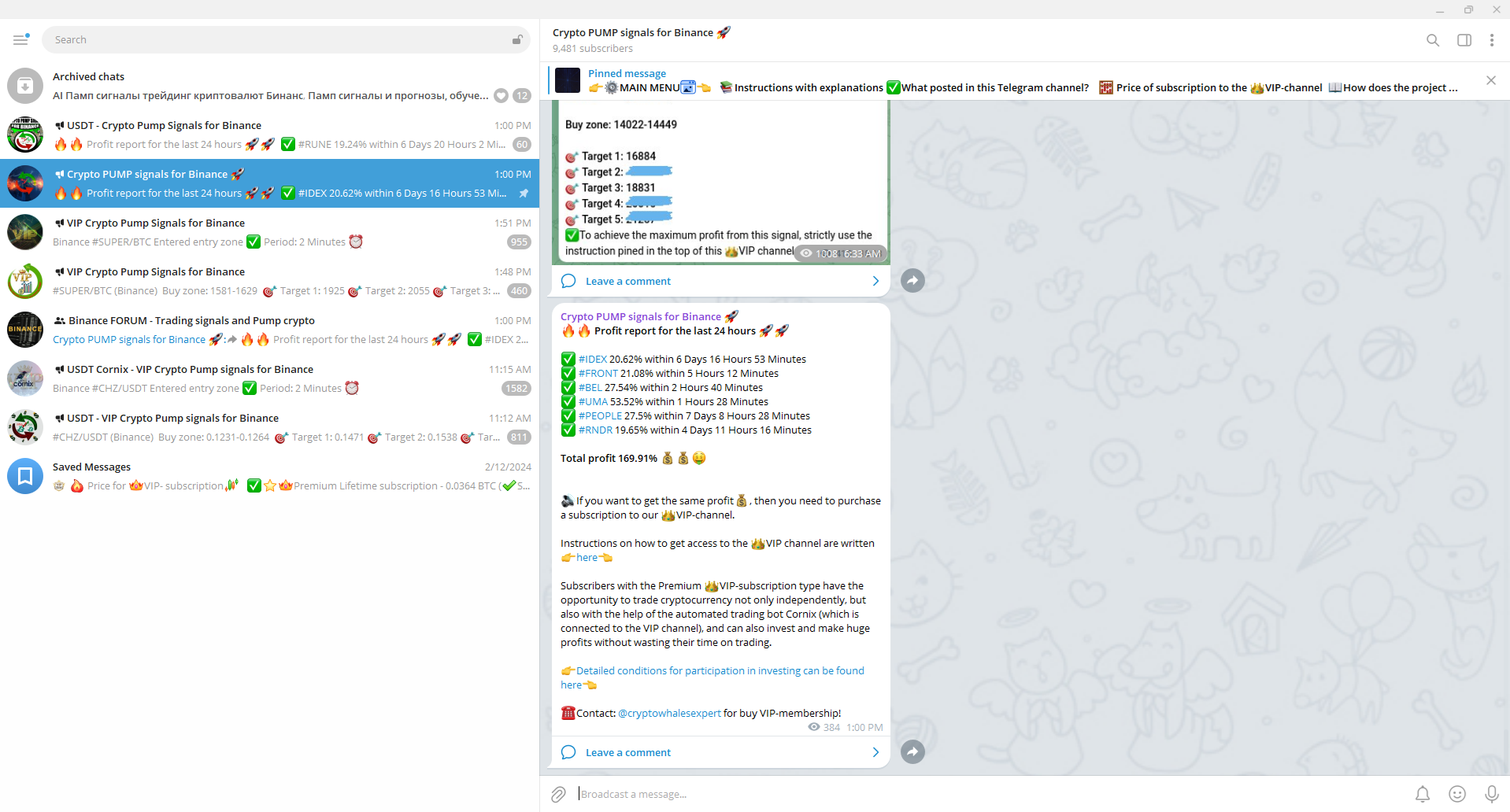

Obtaining Trading Signals with Information on Future Cryptocurrency Price Growth in the Telegram Channel “Crypto Pump Signals for Binance”

In the realm of cryptocurrency trading, accessing reliable signals forecasting imminent price surges is pivotal for traders seeking lucrative opportunities. The Telegram channel “Crypto Pump Signals for Binance” emerges as a beacon, offering subscribers valuable insights derived from meticulous market analysis. This channel serves as a reservoir of actionable intelligence, furnishing traders with premonitions regarding the upcoming spikes in cryptocurrency values.

Subscribers gain exclusive access to meticulously curated data, meticulously crafted by AI algorithms, predicting the impending upswings in various cryptocurrencies. Each signal encapsulates a comprehensive analysis, presenting subscribers with crucial information such as the coin’s name, optimal entry price range, and strategically devised exit points. This arsenal of insights equips traders with a blueprint for navigating the volatile cryptocurrency landscape, enabling them to capitalize on burgeoning market trends.

| Key Features of “Crypto Pump Signals for Binance” Telegram Channel: |

|---|

| 1. Insider Insights: Subscribers receive privileged access to insider information meticulously analyzed by AI algorithms. |

| 2. Transparent Data: Each signal is accompanied by corroborative evidence, including screenshots of trading signals from the premium channel. |

| 3. Timely Notifications: Signals are disseminated promptly, ensuring traders capitalize on emerging opportunities swiftly. |

The unparalleled accuracy and reliability of these signals underscore their indispensability in the arsenal of every astute cryptocurrency trader. By leveraging the insights furnished by “Crypto Pump Signals for Binance,” traders can navigate the intricacies of the cryptocurrency market with confidence, poised to capitalize on lucrative opportunities as they arise.

Subscribers gain access to meticulously analyzed market insights driven by AI algorithms. These insights include the identification of coins poised for imminent price surges, recommended entry price ranges, and five strategically timed exit points, ensuring returns ranging from 20% to 45%.

| Key Points | Details |

|---|---|

| Accurate Market Analysis | The channel employs cutting-edge AI algorithms to scrutinize market trends, providing subscribers with accurate forecasts. |

| Identification of Promising Coins | Subscribers receive insights into coins expected to experience significant price appreciation in the near future. |

| Entry Price Range | Clear guidance is offered on the optimal price range for entering trades, maximizing profit potential. |

| Strategic Exit Points | Five exit points are recommended, each designed to ensure profitable outcomes for traders. |

| Risk Mitigation | By leveraging insider information, traders can mitigate risks associated with cryptocurrency trading, enhancing overall safety. |

By subscribing to “Crypto Pump Signals for Binance,” traders gain a competitive edge in the volatile cryptocurrency market. The provision of corroborated insights, including screenshots of trading signals, serves as tangible evidence of the channel’s reliability. These signals, disseminated exclusively to VIP subscribers who have invested in insider information, are meticulously timestamped, providing transparency and credibility.

Why Trust Information on Upcoming Cryptocurrency Pumps in the “Crypto Pump Signals for Binance” Telegram Channel?

At Binance, the fast-paced cryptocurrency trading environment demands reliable signals of market movements for successful market investments. One reliable resource in this regard is “Crypto Pump Signals for Binance”, providing insight into impending price surges across digital assets. But why does this channel stand out?

One of the hallmarks of this Telegram channel is its dedication to transparency and verification, regularly posting screenshots featuring trading signals from premium channels to show concrete proof that predictions made are correct and make their mark on upcoming pump cycles. These screenshots, accessible only to VIP subscribers who purchased insider information regarding forthcoming pumps, serve as tangible proof that this Telegram channel’s reliability.

As well as transparency, this channel prides itself on timeliness as an element of credibility. Each trading signal includes specific details regarding date and time of its publication – providing subscribers with accurate information that helps inform trading decisions with greater ease and trustworthiness. Taking such steps not only builds relationships amongst subscribers but provides actionable insights for traders as well.

Additionally, individual coin analyses further cement this channel’s credibility. By delving deeper into each cryptocurrency that could benefit from being pumped up, subscribers gain greater insight into market dynamics that play out at play – instilling trust and positioning it as an authoritative source amongst an unpredictable crypto landscape.

Ultimately, the “Crypto Pump Signals for Binance” Telegram channel distinguishes itself through its commitment to transparency, timeliness, and thorough analysis. By offering verifiable evidence of successful predictions and ensuring subscribers are equipped with the latest information, the channel fosters trust and empowers traders to navigate the complexities of cryptocurrency pumps with confidence.

| Key Features: |

|

|---|

Why AI-Powered Prediction Methods are Significantly More Accurate and Secure for Traders?

When attempting to forecast which digital assets might experience significant price increases in the short term, traders often resort to various techniques, ranging from technical analysis to market sentiment evaluation. However, relying solely on manual analysis can be time-consuming and prone to errors.

This is where the application of Artificial Intelligence (AI) in Telegram community “Crypto PUMP signals for Binance” comes into play, revolutionizing the landscape of cryptocurrency trading. AI-driven prediction models leverage advanced algorithms to analyze vast datasets, identifying patterns and correlations that human analysts might overlook.

AI systems leverage machine learning and neural networks to analyze complex market data in real time, giving traders valuable insight into potential pump opportunities. Their algorithms continually evolve based on historical information to adapt to shifting market conditions while continuously increasing prediction accuracy over time.

AI platforms also can reduce risks related to pump-and-dump schemes, where coordinated efforts artificially inflate cryptocurrency prices before quickly selling off, leaving unwitting traders at a loss. By detecting abnormal trading patterns or flagging suspicious activities, these algorithms offer traders another layer of protection and peace of mind.

Ultimately, while predicting cryptocurrency pumps manually remains a possibility, the utilization of AI-driven prediction methods significantly enhances accuracy and security, empowering traders to make informed decisions and capitalize on lucrative opportunities in the dynamic crypto market.

What are some advanced strategies in crypto trading using artificial intelligence (AI) for short-term growth predictions on Binance exchange?

Innovative techniques in cryptocurrency trading often utilize artificial intelligence (AI) algorithms to analyze market data and predict short-term price movements on platforms like Binance. Such techniques include various AI models like machine learning algorithms, deep learning neural networks and natural language processing (NLP) algorithms. By analyzing historical price data, trading volumes, social media sentiment analysis and other factors relevant to trading – AI systems can identify patterns or trends which human traders might miss allowing more informed decision making by traders as they capitalise on short-term price fluctuations in cryptocurrency markets.

How do AI-powered methods predict the development dynamics of coins on Binance exchange?

AI-powered methods used to predict the growth dynamics of coins on Binance utilize complex algorithms trained on historical market data, to study past price movements, trading volumes, sentiment analysis and external influences such as news events or regulatory developments. With machine learning techniques such as deep learning being applied through machine learning/deep learning techniques that identify patterns or correlations within data to generate forecasts regarding future price movements; continuously adapting their predictions with newly acquired information such as news events/regulation developments enables these AI models to provide accurate forecasts about short-term cryptocurrency growth opportunities listed on Binance exchange.

What indicators can AI systems use to identify tokens likely to increase in price in the coming days?

AI systems utilize both technical indicators and fundamental analysis in tandem with each other to quickly identify promising tokens with price growth potential. Technical indicators, like moving averages, relative strength index (RSI), Bollinger Bands help AI algorithms analyze current market trends and momentum of specific tokens; additionally fundamental factors like project’s technology team partnerships market demand are studied as measures of long-term viability/growth potential for these coins. When combined together AI based methods target tokens that are undervalued or experiencing positive momentum which suggests their price increase soon enough.

How are AI-driven techniques helping traders make decisions regarding short-term cryptocurrency investments on Binance?

AI-powered techniques help traders make informed decisions regarding short-term cryptocurrency investments on Binance by providing data-driven insights and predictive analytics. AI systems use machine learning algorithms to analyze vast amounts of historical and real-time market data in order to detect patterns that human traders might miss, while probabilistic forecasting tools provide traders with reliable projections about future cryptocurrency price movements on Binance – helping traders make more informed decisions and capitalize on short-term trading opportunities in this unpredictable cryptocurrency market.

What role do natural language processing (NLP) techniques play in AI-powered price prediction tools on Binance?

Natural language processing (NLP) plays an integral part in artificial intelligence-powered techniques for forecasting short-term price movements on Binance by analyzing text from news articles, social media posts and cryptocurrency forums. NLP algorithms use text data analysis techniques to extract valuable insights and sentiment analysis regarding specific cryptocurrency portfolios. As NLP-powered AI systems can monitor market participant sentiment and identify events or developments which could influence prices, they can increase accuracy in price predictions. Integrating NLP into other AI techniques enables comprehensive analysis of both quantitative and qualitative factors impacting cryptocurrency markets thereby improving short-term forecasting models’ effectiveness.

Progressive techniques in crypto trading using AI involve leveraging machine learning algorithms to analyze market data, identify patterns, and make predictions about the short-term price movements of coins. These techniques often utilize advanced mathematical models and historical data to train AI algorithms to recognize profitable trading opportunities.

How do these AI-driven methods predict the growth dynamics of coins on the Binance exchange?

AI-driven methods for predicting growth dynamics on Binance typically involve analyzing various factors such as historical price data, trading volume, market sentiment, and even external events like news and regulatory developments. Machine learning algorithms process this information to identify patterns and correlations that could indicate potential price movements in the short term.

Can AI accurately determine which coins are likely to increase in price in the coming days?

AI can provide insights into which coins might increase in price in the near future by analyzing a multitude of factors. While no method can guarantee absolute accuracy, AI algorithms can identify trends and patterns that suggest certain coins may experience growth. However, it’s important to note that cryptocurrency markets are inherently volatile, and unexpected events can impact price movements.

What are some of the promising tokens identified by AI for potential price growth in the short term?

AI algorithms may identify promising tokens based on various criteria such as market trends, trading volume, project developments, and social media sentiment. Some tokens that AI might flag for potential price growth in the short term could include those with upcoming product launches, partnerships, or significant community engagement. However, investors should conduct their own research and consider multiple factors before making investment decisions.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.