Do you know the cryptocurrency market operates 24/7 and generates daily trade volumes of over $100 billion?

24/7 Crypto Exchange presents investors with unique profit opportunities round-the-clock. While traditional stock market traders wait patiently for trading sessions to commence, cryptocurrency investors play an active role in earning profit and see opportunities come their way all day long.

Modern technologies and automated systems enable traders to take full advantage of what the market provides 24/7, even while sleeping. Effective trading strategies and tools can produce stable income while mitigating risks.

This comprehensive tutorial will teach you how to trade cryptocurrency 24-7 using proven strategies and modern automated technologies.

Due to 24/7 trading operations and unique trading opportunities, cryptocurrency markets stand apart from more conventional financial platforms.

Cryptocurrency markets are available 24 hours per day, giving traders the ability to trade at any hour of day – but peak activity generally occurs between 8:00 am and 4:00 pm local time and American market hours, when trading volume and liquidity can change substantially depending on what time it is.

Cryptocurrencies offer traders many benefits: 24/7 trading of digital coins brings many benefits for traders:

- Real-time response to events and news.

- Trading schedule that can be modified for any time zone

- Global coverage increases liquidity.

- Being able to arbitrage between exchanges can help in mitigating risk exposures.

- Market access regardless of location

Tools and Platforms

It is crucial that if you wish to trade successfully on the cryptocurrency market, that the right trading platform be chosen. Decentralized platforms offer more privacy and security while centralized exchanges tend to offer higher liquidity levels. When choosing between platforms it is essential that factors such as transaction fees, supported crypto currencies and analytical tools be carefully considered.

Modern trading platforms feature sophisticated market analysis features, including charting, indicators for technical analysis and automated trading capabilities. Security should always be prioritized; only choose exchanges that boast excellent track records and use cold storage as this ensures maximum protection of assets.

Automating trading processes has become an essential element of cryptocurrency’s success, particularly on 24/7 markets. Modern technology streamlines and automates this trading process while decreasing human interference in decision making processes.

Selecting Trading Bots Trading bots automate trades based on specified parameters. When choosing one for yourself, keep these factors in mind when choosing:

- DCA Bots to Avert Purchase Costs

- Trading bots that operate over specific price ranges.

- Arbitrage bots: Automated programs used for taking advantage of price differentials between exchanges to generate profit.

- AI Bots: Utilizing artificial intelligence for market analysis

Setting up automated trading is crucial. Here are a few parameters you need to keep in mind for optimum trading:

Order Type, Application Features and Device Features TWAP Large Volumes Divided Into Small Parts For Trail Stop Trend Following and Automatic Adjustments Trailing Stop Trailing Stop Trend Following Automated Adjustment combined Orders Interrelated Conditions are as follows.

For successful currency exchange, it is imperative that:

- Create limited API keys (for trading only).

- Configure two-factor authentication

- Maintain detailed activity logs.

- Store strong passwords safely.

Avoid giving withdraw rights when dealing with API Keys to ensure greater trading bot security. This method may provide greater peace of mind. Modern platforms allow traders to back-test strategies using historical data. This enables a complete evaluation of their effectiveness before investing real money. You should begin small trades to assess effectiveness before increasing them once confirmed by tests of viability.

Strategies for 24/7 Trading In order to be successful when trading cryptocurrency 24/7, the optimal strategies need to match its specific characteristics. Use proven approaches for sustained profits.

Arbitrage Trading Between Exchanges

An arbitrage trading strategy exploits price discrepancies of cryptocurrency between different exchanges to profit. If Bitcoin trades at $30,000.00 on Exchange A and $31,150.00 on Exchange B respectively, an arbitrage trader might make $150 in profits by employing this technique. Success factors for traders:

- Trade execution speed when taking into account transaction fees

- Maintain liquidity across platforms

- Automating processes using automated bots.

Scalping across Time Zones Scalping, the practice of high-frequency trading which seeks to make small profits on multiple trades at once, must take account of various time zones when operating successfully. As part of your planning when trading internationally:

Automated grid strategies imply using an automated method that generates buy/sell orders at various prices across an extensive price range, creating buy and sell orders as appropriate for sideways markets. Such an automated strategy typically comprises:

- Calculating the upper and lower limits of a trading range

- Set the number of grid rows.

- Calculating Order Volumes at Different Levels

- Automated execution of trades when target prices have been met

Establishing the appropriate risk management system and clearly setting stop-loss/take-profit parameters are of utmost importance in safeguarding capital against unpredictable market movements while creating long-term stable returns on your investments.

Risk Management in Continuous Trading

Successful trading at the crypto exchange requires effective risk management. A system to protect capital as well as track trading positions within continuous operation markets are necessary elements.

Set Stop-Loss and Take-Profit Levels. One key aspect of capital preservation is properly setting stop-loss and take-profit levels on orders placed with cryptocurrency: risk to reward ratio is suggested here as one method to do this:

- Position Type, Stop Loss Take Profit Objectives, Timeframe for Stop-Losses/Profits and Target Profit/Losses for Long Term Positions can all vary significantly and ideally should include Stop-Losses taken profit goals of between 1-2%-2.4% medium term 2-5-10% profit long-term 5-10% 15-20-30%.

- Diversification is an effective multi-level protection strategy.

- Capital Allocation in various cryptocurrencies

- 60 per cent of top crypto currencies such as BTC and Ethereum account for an impressive 60 percent market share.

- 30-35% should be allocated towards promising altcoins and 10-11 % towards high-risk assets using different trading strategies.

Working With Multiple Exchanges

Principle: Don’t invest more than 10% of your portfolio in one asset such as Bitcoin or Ether; although these two cryptocurrencies may account for higher shares. Proper positioning and monitoring in an around the clock work environment are paramount:

- Checking on the effectiveness of your strategies regularly is essential for long-term success.

- As market conditions shift, adjust bot parameters accordingly.

- Critical Situation Alert System in place in critical situations.

- Balance the portfolio every two to four weeks at least.

Working with automated systems requires taking certain measures in order to close all positions automatically once your portfolio has reached a specific threshold (i.e. 15-20% of its peak value).

Hedging, by way of derivatives or opposite orders, can provide protection during times of high market volatility. To preserve growth potential for your portfolio and avoid diluting its growth potential too quickly, only hedge up to 30%.

In order to optimize trading efficiency on 24/7 Crypto Exchange, it’s crucial that you carefully manage and update the performance of your trading system on an ongoing basis. Stable results can only be attained using automated trading tools that have been properly set up and updated on a consistent basis.

Analysis Bot Performance

In order to properly evaluate trading bot performance, it’s vital that certain key metrics are tracked.

Metric Description Target Value ROI Return on Investment>2% per month WIN RATE Percentage of successful trades>60%Drawdown Maximum capital decrease15%Holding Time Duration of position Depending upon strategy.

Regular back testing on historical trading data is crucial in order to identify any possible problems and optimize trading parameters. A complete alert system includes notifications in various forms:

Important Warnings: Reaching Stop-Loss Limits or Bot Operations Not Operating Properly.

At all stages, to ensure reliable monitoring of trading processes it is recommended to utilize multiple alert mechanisms with diverse communication channels. A multilevel alert system should provide adequate protection.

Update trading strategies regularly Successful trading strategies must be optimized based on:

- Analysis of market conditions and changes in volatility

- Assess of Current Settings (ATS)

- Addition of new parameters in an Existing Demo Account

- Change implementation on an actual account

Progressive updates of strategies and parameters help minimize risk while upholding system stability and keeping trading open and active.

Maintain the effectiveness of automated trading by conducting regular analyses – at least every two to four weeks – specifically during periods of high market volatility or strange behavior. Pay special attention during these moments of increased interest on your market!

As cryptocurrency operates 24/7 and uses modern automation technology to generate profits, its profitability opportunities present themselves even while sleeping. By employing proper risk management techniques along with trading strategies and automated solutions, cryptocurrency offers unparalleled return potential.

Trading cryptocurrency exchanges is only successful if the appropriate trading bots have been set up and regularly monitored; any necessary parameter adjustments made quickly. Diversifying strategies while safeguarding capital with stop loss settings are both key aspects to consider for optimal success in cryptocurrency trading.

Staying abreast of changes and adapting to them on the crypto market are ongoing processes, which is why developing an automated trading system takes time, focus, and dedication. You can achieve success by regularly assessing results, exploring alternative approaches, and testing various strategies – something your automated trading system should also do automatically for you!

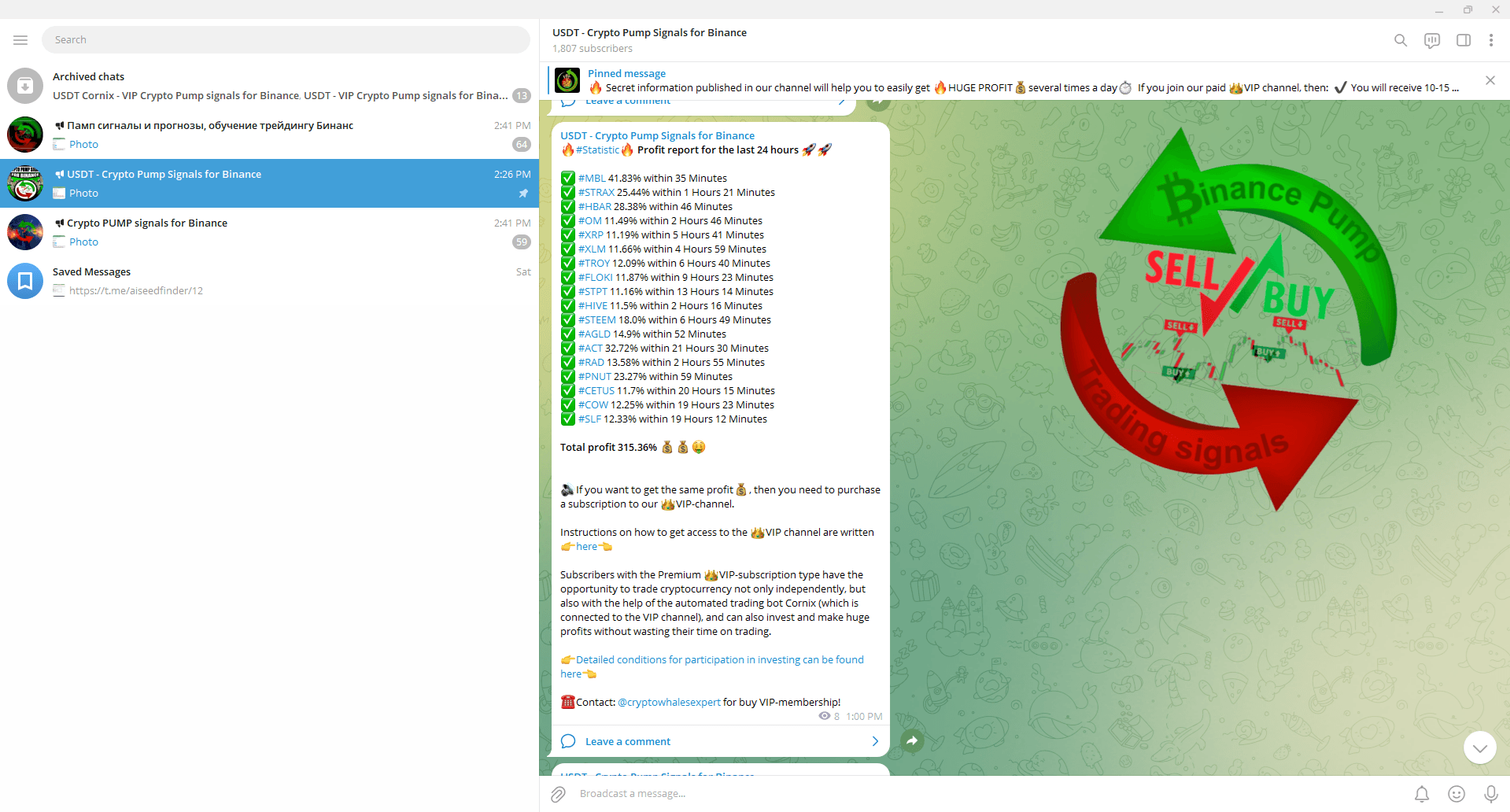

Crypto Pump Signals for Binance is an innovative project that equips traders and investors with essential cryptocurrency news via Telegram’s artificial intelligence features and its trading platform’s sophisticated algorithmic analysis engine. Crypto Pump Signals focuses on altcoins which offer some of the greatest returns.

This channel stands out from its competition because of the way in which it publishes and predicts pump signals for investors to access accurate forecasts that increase their success chances. Traders and investors will find this information especially beneficial as they make informed decisions that contribute towards successful investing decisions and ultimately ensure greater financial returns.

Cryptocurrency pumping refers to any rapid and sudden price rise caused by massive buying. This phenomenon could occur for various reasons such as new information being released, changes in market dynamics or manipulation from large investors; traders can use pump signals to predict such events and profit off short-term fluctuations.

Pump Signals alert traders of future price increases of specific cryptocurrencies. This set contains the following signals:

Name, Recommended Price to Purchase (BUY ZONE), Target Metrics of Sales, Pump Predictions (including date/types/timing of each pump depending on VIP Subscription Type and next Pump Time/date/type. These data enable fast decision-making when buying or selling assets.

Benefits of Crypto-Pump Signals

Subscriptions provide subscribers access to exclusive information. As subscribers get updated information first on pump technology developments before other traders, giving them an edge in their chosen markets.

Trading bots: Automatic trading platforms use signals to allow traders to earn while sleeping! Traders who utilize automated trading signals may make money while sleeping!

Join our trading community to meet like-minded traders. Take note of other’s strategies while sharing your own.

Binance Crypto Pump Signals go beyond simply anticipating profitable pump events to provide traders with accurate signals that allow them to accurately forecast market movements – giving them a trading advantage and giving them access to higher returns than would otherwise be available from trading alone.

By joining this channel, traders and investors gain access to an expansive community with similar goals who all seek success in trading or investing. Sharing market information, strategies, analyses with fellow members of this network increases your odds of making profits more likely than before.

Binance’s Crypto Pump Signals provide traders, both experienced and novice alike, with invaluable guidance when trading short-term cryptocurrency markets. Thanks to advanced technology and expert analysis, investors now can view short-term cryptocurrency trading with fresh eyes.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.